Brick-and-Mortar Retail Isn’t Going Away

Robust e-commerce sales by traditional retailers during the COVID-19 pandemic create a lasting role for physical stores.

The surge in online shopping at the beginning of the coronavirus pandemic led to a series of rash proclamations about the demise of brick-and-mortar U.S. retail. Since then, much of the pandemic's initial boost to e-commerce adoption has already faded away, and we expect mass vaccination to bring further convergence to the pre-pandemic trend. Still, we've learned a lot about the future of e-commerce and U.S. retail thanks to the pandemic experiment.

The biggest surprise has been the rise of omnichannel (e-commerce sales by traditional retailers), which has astoundingly outperformed online retailers during the pandemic. We think this outperformance will continue into the next decade.

Our upbeat outlook for traditional retailers' omnichannel sales doesn't translate into buying opportunities for those names, however, as it looks like the market is baking in even rosier projections. Instead, retail REITs are the best buying opportunity. Strong omnichannel growth means that retailers will maintain an extensive footprint even while paring back lower-quality locations.

The Rise of Omnichannel

Omnichannel outperformance was an entirely new development, as before the pandemic, omnichannel sales were growing at about the same rate as online retailers' sales. Further, much of the narrative around U.S. retail centered on how long-term uptake of e-commerce would lead to disruption of traditional retailers. By tapping into omnichannel, traditional U.S. retailers generated strong sales growth in 2020, even as industrywide brick-and-mortar sales were about flat for full-year 2020.

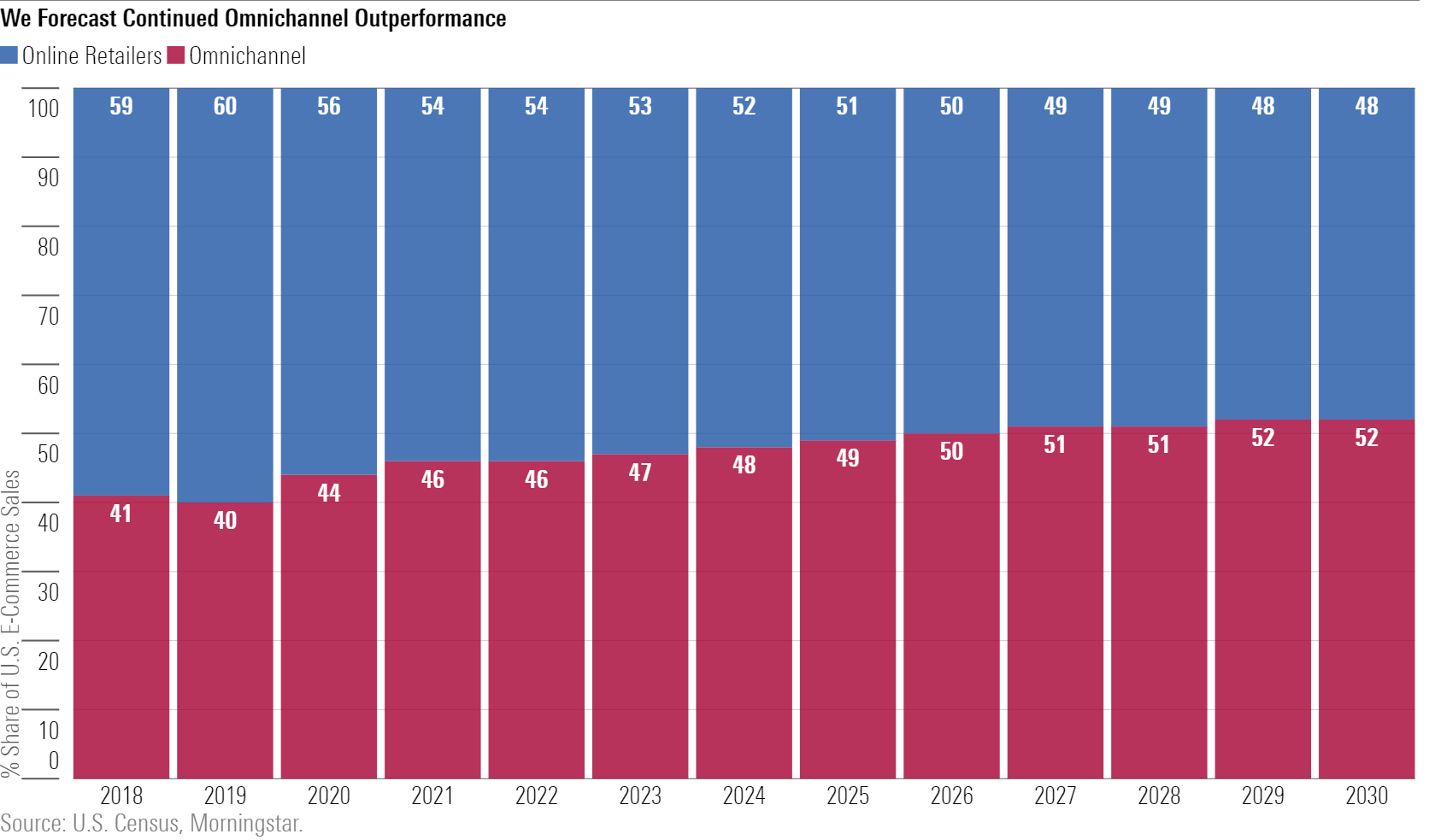

Omnichannel has dramatically outperformed online retailers during the pandemic, increasing to 44% of U.S. e-commerce sales in 2020 from 40% in 2019.

We Forecast Continued Omnichannel Outperformance

We think the pandemic experiment provided some useful perspective regarding the next leg of e-commerce adoption, supporting our contention that omnichannel will outperform. Omnichannel was clearly very popular among new e-commerce shoppers (given that both rose in tandem in 2020). We think this was partly the result of consumers' established trust and familiarity with existing retail brands, which carried over when they were abruptly forced to shop online. This suggests that traditional retailers have a leg up on transitioning their customer base to e-commerce (so long as they can match the e-commerce capabilities of online-first competitors).

New tools, such as the Shopify SHOP ecosystem, are enabling even very small brick-and-mortar retailers to tap into omnichannel sales. Previously, many of these retailers likely found omnichannel operations (such as maintaining a website with payment capability, or handling fulfillment) too daunting to embark upon.

We project that omnichannel will rise to 52% of e-commerce sales by 2030, up from 40% in 2019. The pandemic provided a glimpse of the future for the next wave of e-commerce adoption, and omnichannel looks to play an outsize role. Many traditional retailers have made large investments in omnichannel capabilities in recent years, and now these investments are clearly paying off.

We Forecast Continued Omnichannel Outperformance

Selling Opportunities Among Overvalued U.S. Retailers

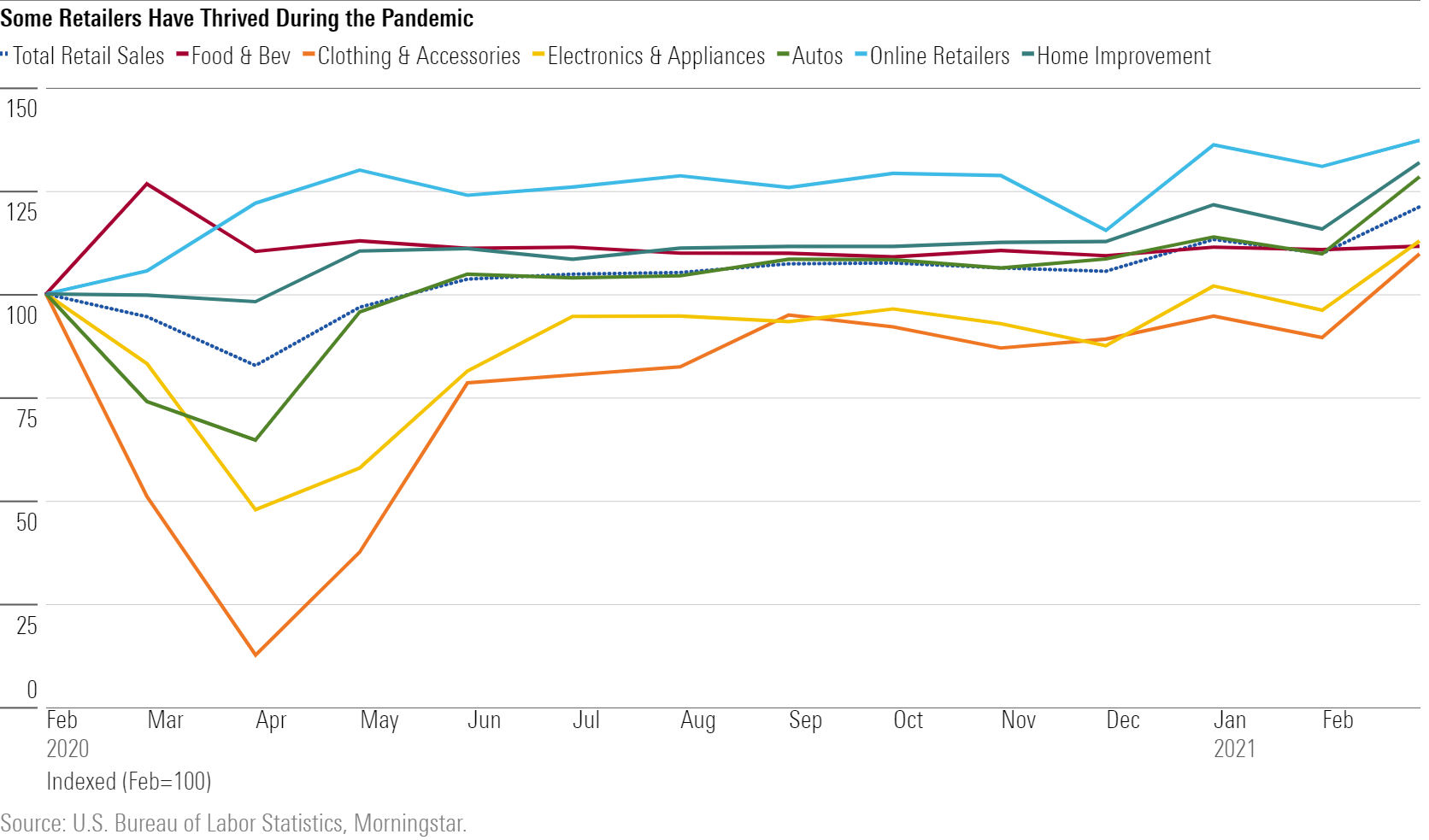

U.S. retail sales soared during the pandemic, but this uptick in retail sales hasn't treated all retailers equally. Unsurprisingly, online retailers have thrived, given the shift to e-commerce. However, even some retailers focusing on physical sales have also done well, such as the home improvement and the food and beverage categories. While these retailers have seen noticeable e-commerce adoption during the pandemic, they've also seen heavy foot traffic in physical stores.

Some Retailers Have Thrived During the Pandemic

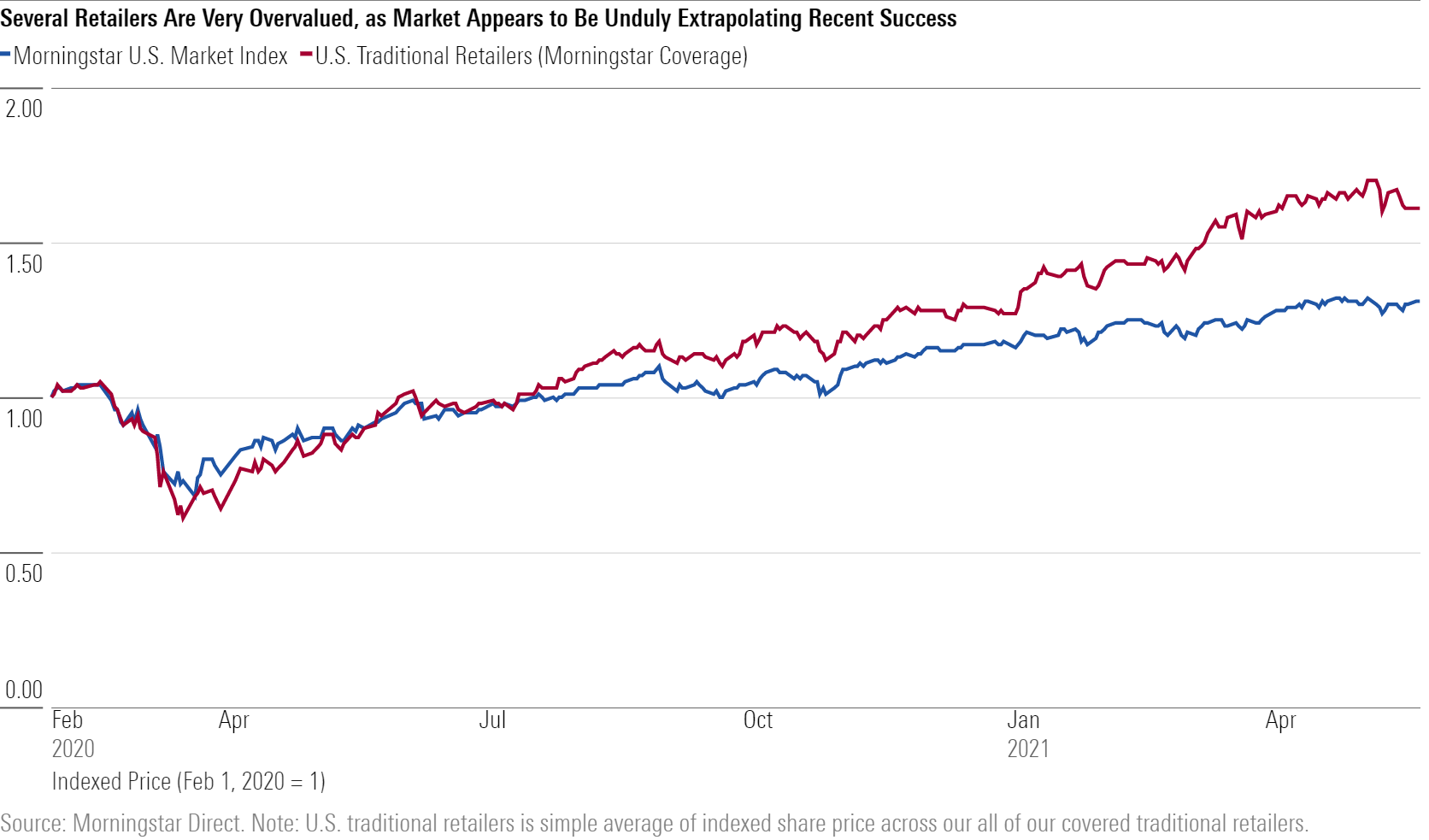

While we're upbeat on U.S. retailers' ability to garner market share and boost profitability owing to their omnichannel future, it looks like the market is even more optimistic than we are about retailers' prospects.

Thanks to strong share price performance since the initial pandemic crash, we don't see many buying opportunities among U.S. retailers. As of May 25, 2021, share prices for our average covered U.S. traditional retailer are up over 60% since February 2020, actually outperforming the overall U.S. market index (up about 30%). As a reminder, this cohort only includes traditional retailers--major online-only retailers (notably Amazon.com AMZN) are excluded.

Several Retailers Are Very Overvalued, as Market Appears to Be Unduly Extrapolating Recent Success

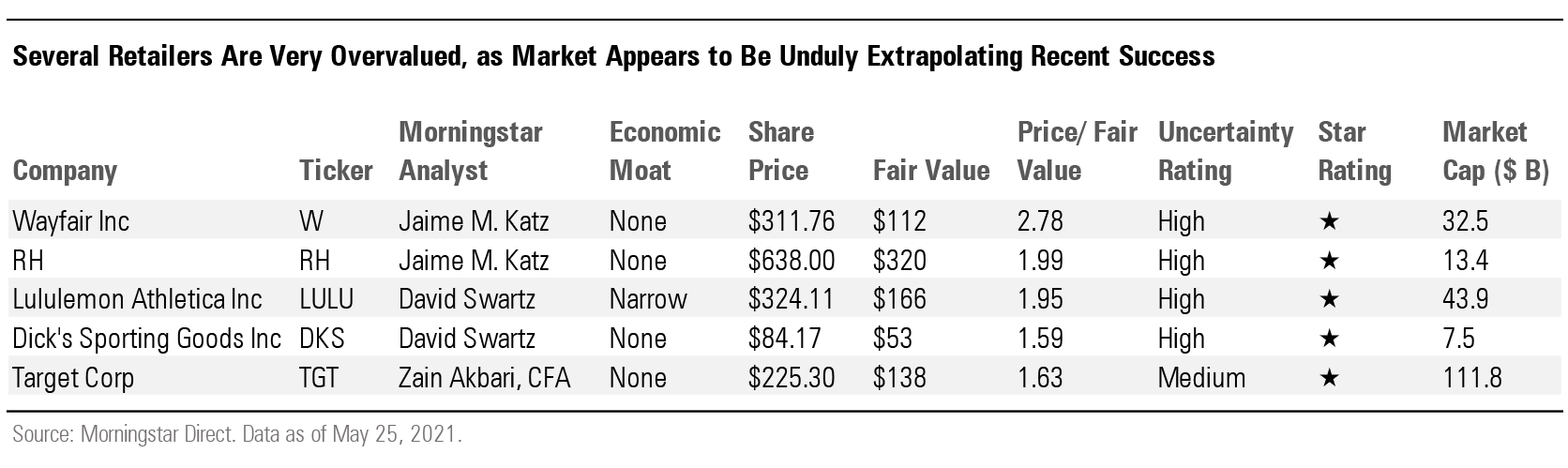

The stocks highlighted in the table below are notable selling opportunities. All the companies in this list have seen very strong growth during the pandemic--even outpacing overall U.S. retail sales. Investors appear to be unduly extrapolating this windfall in sales going forward. Likewise, investors may be overrating retailers' long-term margin potential, given the surprisingly good performance during the pandemic.

Several retailers Are Very Overvalued, as Market Appears to Be Unduly Extrapolating Recent Success

Buying Opportunities Among Undervalued Retail REITs

While investors remain concerned that the continued growth of e-commerce is a large, structural negative trend for brick-and-mortar retail, we believe that the omnichannel strategy being increasingly pursued by most national retailers favors the high-quality portfolios owned by the retail REITs.

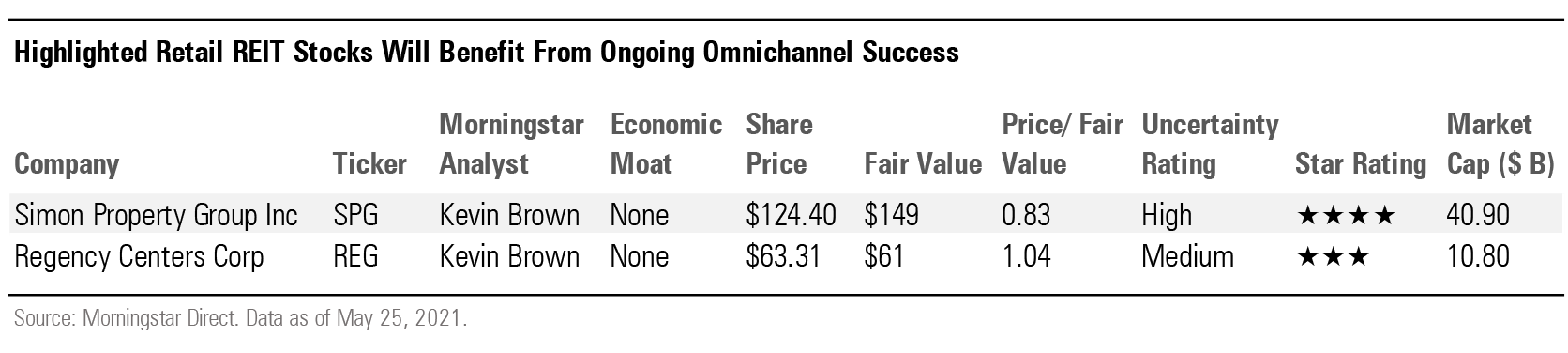

Highlighted Retail REIT Stocks Will Benefit From Ongoing Omnichannel Success

Retail REITs typically trade off on major retailers announcing store closures or reports of large e-commerce gains, with the implication that gains by e-commerce will negatively affect future sales and thus occupancy of the retail REITs. However, while many retailers are closing stores, these are typically at lower-quality malls and shopping centers.

The above retail REITs have significantly increased the average quality of their portfolios over the past two decades, recycling the proceeds from the sale of older, lower-quality properties into acquiring newer, more-productive centers. Retailers are more likely to retain these higher-productivity stores, as they have the necessary demographics to support high sales growth and thus store profitability.

While many malls and shopping centers will close as a direct result of increased e-commerce penetration, we think the portfolios of the retail REITs will remain vital to omnichannel retailers and the U.S. consumer in the decades to come. We see some mall REITs and shopping center REITs as being undervalued by the market today, given the importance of these centers to the future of omnichannel retail.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)