Big Biopharma Capital Allocation Supports Undervalued Stocks and Dividend Growth

Our top two picks in this wide-moat industry are poised to benefit.

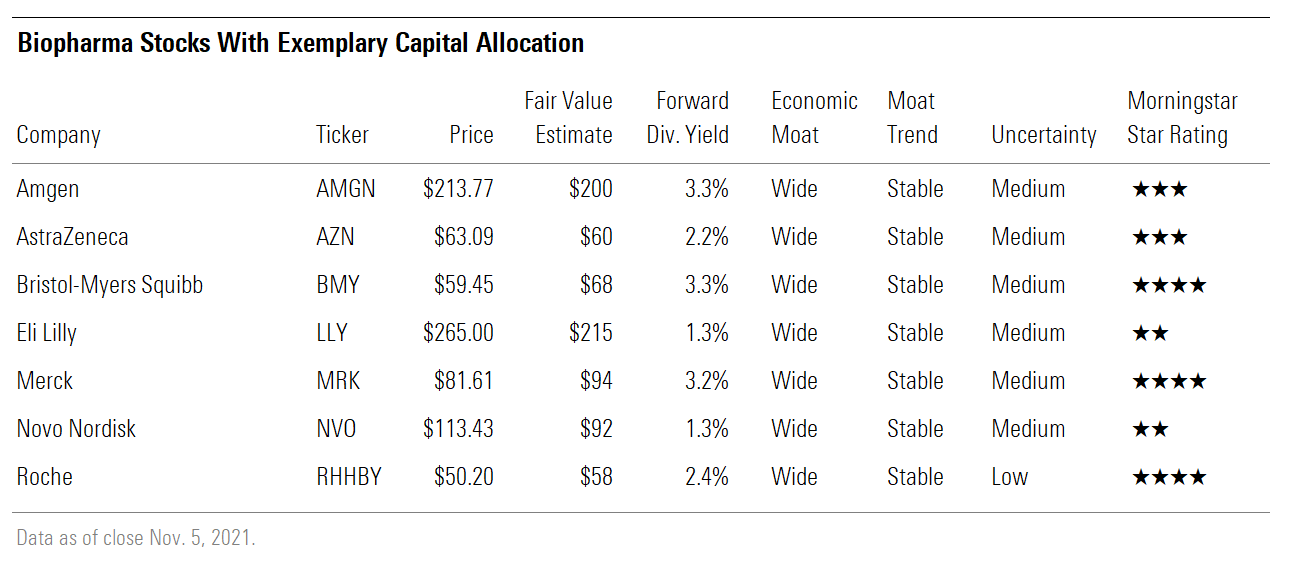

Overall, the large-cap biopharmaceutical group has strong balance sheets, makes solid investment decisions, and distributes cash appropriately. All of this supports the ability to develop the next generation of innovative drugs that are critical to an almost entirely wide-moat industry. With the current portfolios of the industry likely to become generic over the next two decades, capital allocation is particularly important for biopharma companies. For this group, differentiation in capital allocation generally lies in high levels of research and development targeted toward areas of unmet medical need, with leading companies AstraZeneca AZN and Eli Lilly LLY poised to generate top-tier, industry-leading growth. Underappreciated strong capital allocation supports our undervalued stock calls for Roche RHHBY and Merck MRK.

- Roche has exemplary capital allocation that the market appears to underappreciate. Its developing pipeline has been built on strong capital allocation decisions, including investing at an industry-leading level of R&D with a strategy of pursuing unmet medical needs.

- We view upcoming inflection points in Merck's capital allocation decisions targeted toward acquisitions and internal pipeline development, which should improve drug-development efforts while also addressing concerns about the large and growing dependence on Keytruda.

- Solid capital allocation decisions made overall at the large-cap biopharma companies support secure dividends that should continue to grow (excluding GlaxoSmithKline GSK) and should drive close to half of the overall total returns for the group.

Productive Reinvestment Is Critical to Support Moats

The majority of the large-cap biopharma companies we cover have economic moats, but almost all the drugs they currently sell will face generic competition over the next two decades, making successful capital allocation critically important in securing their current strong moat ratings. We believe the patent life of drugs (typically 20 years, but with many of those years used during development) makes the biopharma group particularly reliant on successful redeployment of capital because of the need to constantly reinvent drug portfolios. We view a key part of successful capital allocation at big biopharma companies as a combination of sound internal R&D--both in magnitude of investment and in strategic focus on innovative therapeutic areas--and successful external acquisitions and partnerships. The combination of successful internal development and external deals allows the industry to consistently reinvent product portfolios and secure economic moats, protecting high returns on invested capital.

Big Biopharma Capital Allocation Ranges From Standard to Exemplary

Overall, we view the biopharma group’s capital allocation as ranging from standard to exemplary. We see each company’s investment strategy as the key differentiating factor, with exemplary companies’ strong R&D investments generally driving stronger total shareholder returns. We view Amgen AMGN, AstraZeneca, Bristol-Myers Squibb BMY, Eli Lilly, Novo Nordisk NVO, and Roche as exceptional capital allocators.

We think shareholder distributions are about right for the majority of the large biopharma group. Partially due to steady and thoughtful investments in R&D, the industry supports consistent dividends that have rarely been cut over the past two decades. With solid capital allocation allowing for close to 50% payout ratios for the group, we believe investors looking for steady dividend income should consider the large-cap biopharma industry.

The biopharma group tends to allocate spending in the following order: R&D, acquisitions, dividends, share repurchases, and capital expenditures.

Balance Sheets Sound, but Capital Redeployment Can Look Lazy

We believe the large biopharma industry holds largely sound balance sheets with low levels of risk regarding the size of the debt carried, business cyclicality, and the overall debt maturity outlook. While an argument could be made to increase the leverage of the balance sheets to be more active in investing, we believe large-cap biopharmas should hold ample balance sheet strength and extra cash capacity ready to support opportunistic acquisitions as dynamic scientific data emerges. Companies need to be ready to actively participate, harnessing the next generation of scientific advancements to maintain competitive portfolios. They also need to be ready for unforeseen product litigation. A strong balance sheet helps biopharma companies through most product litigation challenges with minimal concern from the market.

Low Business Risk Helps Support Balance Sheets The high inelasticity of drug demand creates low revenue cyclicality, which allows for more flexibility in the balance sheet as major changes in the economic cycle will not have as much of an impact on drug sales. There is a relatively low correlation between economic cycles and the demand for biopharma products. Even through the challenging recession of 2008-09, the biopharma group largely performed independently of macro pressures. The relatively low-fixed-cost base and high operating margins provide further flexibility for the balance sheet. The consistent demand dynamic for drugs along with low operating leverage sets up low overall business risk for the biopharma group. This allows more leeway in managing balance sheet leverage relative to other more economically sensitive industries with higher capital infrastructure, which should give the biopharma group more flexibility to invest in R&D.

Ready to Acquire and Defend Against Product Lawsuits Biopharma companies hold conservatively managed balance sheets, which may suggest a lazy redeployment of capital. However, we argue that these companies need capital ready for acquisitions that may emerge quickly due to unpredictable scientific discoveries. Many times, major scientific advancements happen at smaller biotech companies or academic institutions. To defend their product portfolios and create the next generation of drugs, large-cap biopharma companies need to be ready to redeploy capital to acquire companies and license technology created externally.

They also need to always be ready to defend against lawsuits that can emerge without a clear pattern. Despite extensive clinical studies, some drugs reach the market with a side effect profile that is not fully known or documented in the prescribing label. As patients take newly launched drugs, previously unknown safety issues can arise, albeit rarely. Even though safety issues might be related to other factors such as the underlying disease, in some cases the drug is causing side effects that were not fully communicated to the healthcare community, which opens up its manufacturer to litigation. Over the past couple of decades, several very prominent drug recalls and new safety findings have resulted in major litigation costs and lost sales. Given the high probability of continued litigation, we believe holding a conservative balance sheet enables drug companies to more easily meet the litigation demands (mostly settlements) without generating much concern from investors or industry partners. However, we think biopharma companies are held to a higher safety standard than other industries, which should reinforce overall trust in the group.

Focus on Acquisitions and R&D, With Varying Magnitude and Success

In the biopharma industry, investments in innovation tend to offer the highest returns on invested capital with the longest duration of cash flows. Investment in innovation largely takes the form of internal R&D and external acquisitions. The biopharma industry focuses on both these areas of investments to develop innovative new drugs. In general, we have seen more success with higher internal investing or acquisitions of very large companies, like Schering-Plough by Merck in 2009. Lower R&D spending (as a percentage of sales) can help current returns but typically causes more growth challenges over time. Also, small acquisitions tend to entail a very competitive process, leaving the acquiring company typically paying full value (or more) for the target with less chance for high returns on the acquisition.

High R&D Spending Tends to Lead to Stronger Growth The biopharma group overall spends close to 18% of sales on R&D, but this varies by company. On the high end of R&D spending are AstraZeneca, Biogen BIIB, Bristol-Myers, Eli Lilly, Johnson & Johnson JNJ, and Roche. Most of these companies have leading pipelines and fairly strong-performing portfolios of currently marketed drugs. At the low end are AbbVie ABBV, GlaxoSmithKline, Gilead GILD, Novo Nordisk, Pfizer PFE, and Sanofi SNY, all of which generally hold weaker pipelines and in some cases lower growth potential as well. GlaxoSmithKline especially is hurting from underinvestment in its pipeline and a poor strategic development focus. Spending more on R&D alone isn't going to drive innovation, as productive strategic decisions are needed as well, the spending rate does seem to amplify the positioning of the company's product portfolio.

Acquisitions Are Mostly Neutral Inherent in biopharma strategy is the need to access innovation externally through acquisitions. However, because all large biopharma companies generate strong cash flows and need to augment internal R&D through external purchases, acquisition targets can be in high demand and end up taking the lion's share of the value of the deal, with the acquiring company gaining little to no value (and in some cases losing value). Over the past two decades, we have seen the largest value creation and innovation expansion with the megadeals of Schering-Plough (acquired by Merck) and Wyeth (acquired by Pfizer). We expect Bristol's megadeal for Celgene will follow this productive path as well. However, megadeals tend not to happen frequently, as management teams tend to favor many smaller tuck-in acquisitions (single-digit billions of dollars) versus megadeals that can have risky integration issues. While many small deals have generated very successful innovative new drugs, many more small deals have failed. While there is less clarity around the difference in probability of successful drug development in megadeals versus small deals, we view small tuck-in deals as typically a highly competitive process and megadeals as less competitive and generally less expensive relative to the underlying assets. As we look at the largest biopharma deals of the past decade, the majority created little value, with the exception of the megadeal for Celgene by Bristol, Pharmacyclics by AbbVie, Genzyme by Sanofi, and the potentially lucky deal Gilead made for Pharmasset.

Overall Distribution of Capital Looks About Right

The large biopharma group tends to distribute over 50% of capital to shareholders, largely through dividends and to a lesser extent share buybacks. With mostly sound balance sheets and steady investments in innovation, we believe the balance is about right. We might advocate for more investment in R&D (internally or through acquisitions), but given the mature nature of the industry and less overall need for cash redeployment into the business, the high dividend payout ratios and share repurchases seem largely fair. We view the industry as growing at a mid-single-digit rate over the next five years, suggesting a mature but not declining industry.

Steady Cash Distributions Support Largely Secure Dividends The strong, diversified drug portfolios at large biopharma companies have largely supported secure dividends, and we expect these dividends to be secure and growing into the future. With the exceptions of Schering-Plough cutting its dividend due the patent loss of Claritin in 2003 and Pfizer cutting its dividend in 2009 to fund the acquisition of Wyeth, the majority of dividends have been secure and growing but still allowing room for solid investments in the business, supporting overall returns. While conglomerate structures and corporate restructurings led to 2021 announced dividend cuts at Bayer BAYRY (heavily influenced by crop science pressures) and GlaxoSmithKline (partially triggered by the consumer healthcare breakoff), respectively, we believe the largely historically consistent dividend by the overall group will likely continue over the next decade. Importantly, we don't see any major near-term patent losses to cause a dividend cut. With all the payout ratios close to 50%, the industry looks well positioned to support secure dividend payments that are likely to post moderate growth in line with earnings growth.

Large biopharmas tend to pay out more earnings in the form of dividends than the overall market. Over the past decade, the S&P 500 had an average payout ratio of 36% compared with close to 50% for the large biopharma group. As a result, we expect the total return of the large biopharma group will be more influenced by dividend yield than capital appreciation, compared with overall market returns. Humira’s loss of exclusivity in the United States. in 2023 is likely to push AbbVie’s payout ratio close to 60%, which we believe is still manageable.

Buybacks Are Secondary to Dividends but Can Play a Role Since 2016, stock repurchases have been a priority for the large-cap biopharmas. The timing of the repurchases largely allowed companies to add value by scooping up undervalued shares. Almost all of these companies engage in share repurchases to offset stock option grants to employees, but some aggressively buy back shares. Since 2016, the leading biopharmas repurchasing shares have been Amgen (over $35 billion), Johnson & Johnson (over $30 billion), Pfizer (over $30 billion), Merck (over $26 billion), AbbVie (over $20 billion), Gilead (over $17 billion), and Novartis (over $14 billion). However, even considering these leaders, most companies spend more on dividends than repurchases. Since 2016, most stocks have been repurchased at a point below their current stock price, supporting good returns on an absolute basis, with the exception of Gilead's stock repurchases in 2016 that look particularly poor, given the largely flat stock price. Even more important is whether the returns on buybacks outperform the cost of capital, which is close to 40% over a five-year period, making buybacks less compelling for several companies. However, with the majority of the large-cap biopharma companies paying high dividends, repurchases help reduce the amount of cash needed to pay future dividends (fewer shares outstanding) and create slightly more flexibility with capital allocation over the long term.

Current Selling Needs Drive SG&A Costs We view selling, general, and administrative expenditures as supporting current sales and operations, rather than a capital allocation decision. Nevertheless, SG&A expense ranges significantly across the biopharma group, which creates more variability in the levels of cash that come back to the companies for longer-term capital allocation decisions. A major driver of differences in SG&A as a percentage of sales is product and geographic mix. The more focused a company is on specialty drugs, the more likely it will have lower SG&A expenses as a percentage of sales, since these drugs typically have high prices and lower marketing needs. Specialty drug utilization is controlled by a concentrated group of physicians, while lower-priced primary-care drugs have much larger prescribing bases.

With the industry’s mix continuing to shift toward specialty drugs, we expect several companies to improve their SG&A margins. We think that should create more optionality for capital allocation and likely margin improvement. AstraZeneca’s industry-high SG&A as a percentage of sales at 36% should fall rapidly as the company is in the midst of shifting its product portfolio toward specialty drugs that shouldn’t need the same level of sales support as the prior portfolio, which was more heavily focused on primary-care drugs.

Biopharma Stocks With Exemplary Capital Allocation

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/d10o6nnig0wrdw.cloudfront.net/10-04-2024/t_e6175f671cee439d9180e460f6081183_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)