2021 Inflation Forecast Heads Higher

Supply-side pressures are behind our increase for this year.

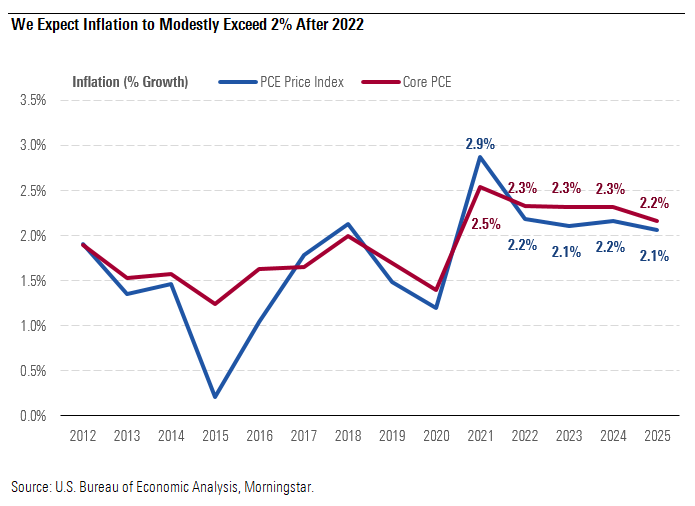

We've increased our 2021 inflation forecast for the Personal Consumption Expenditures Price Index to 2.9% from 2.3% previously. We expect 2021 core inflation of 2.5%. For 2022-25, our forecast is essentially unchanged; we expect moderate core inflation averaging 2.3%, just above the Federal Reserve's 2% long-run target.

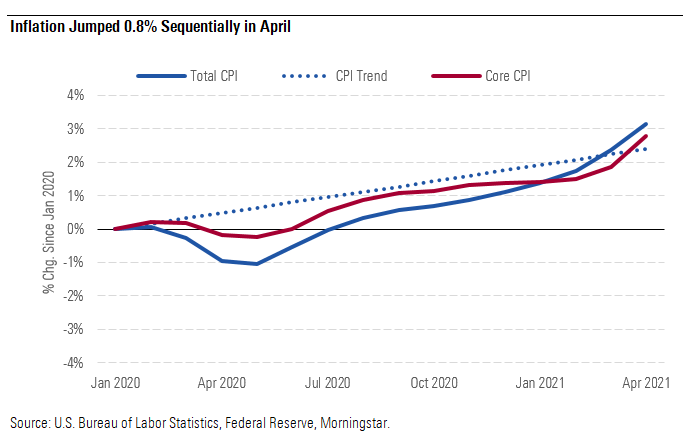

The Consumer Price Index jumped 0.8% in April, following a large 0.6% increase in March. Core inflation increased even faster in April, up 0.9%. In fact, the CPI has made up for its pandemic losses and is now running ahead of its prepandemic trend of 1.9% annual growth.

Bond market inflation expectations have soared in response to the inflation uptick. The five-year break-even inflation rate (the difference in yield between five-year Treasuries and five-year inflation-protected Treasuries) increased to 2.7% in May, the highest level since before the Great Recession.

Inflation Jumped .8% Sequentially in April

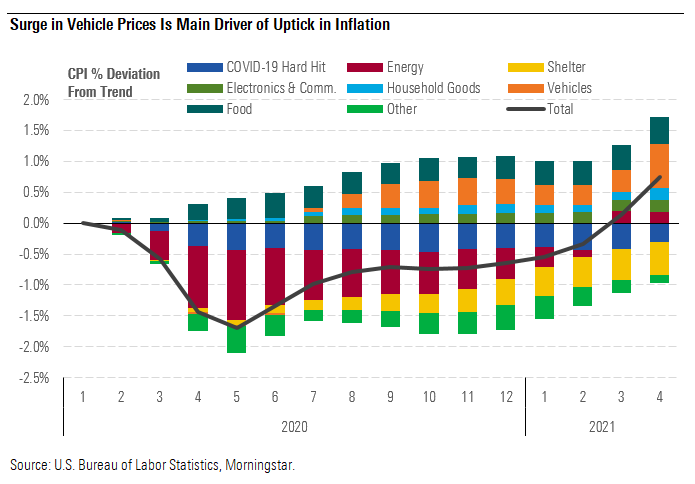

When we decompose the deviation of CPI from trend into various components (based on those components’ average inflation over 2015-19), we see that inflation for new and used vehicles drove most of the April increase and is accounting for most of the positive deviation from trend as of April. This reflects the auto supply chain constraints that have sent vehicles prices through the roof. Food price inflation is also running solidly above trend, reflecting the supply issues in that industry. The broad uplift in inflation since late 2020 is attributable mostly to vehicles along with a recovery in energy prices.

Surge In Vehicles Prices Is Main Driver of Uptick in inflation

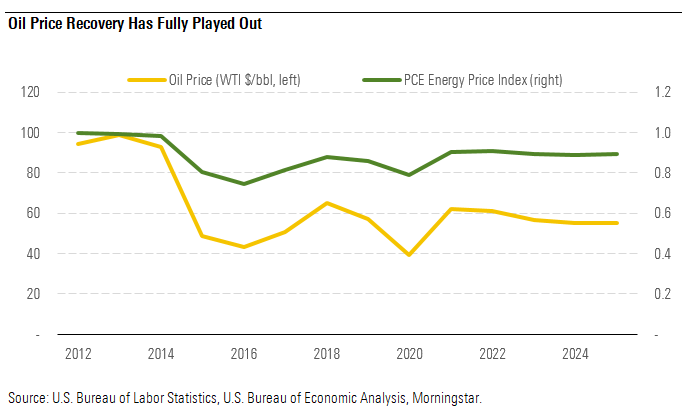

Given our view that these supply chain pressures should be gradually relieved, aided by a shift in consumer demand from goods to services, we don’t think these issues will have a major impact on inflation in 2022 and beyond. Moreover, we think the oil price recovery has fully played out, meaning that energy prices should flatten from here. However, while today’s inflation drivers will eventually fade, new sources of inflation will emerge over the next few years. In particular, we expect the closing of the output gap along with tight labor markets to drive inflationary pressures.

Oil Price Recovery Has Fully Played Out

The closing of the output gap (when gross domestic product equals its potential) means that the recessionary slack in the economy will be gone for the first time since before the Great Recession. Via the traditional Phillips curve relationship, this should mean higher inflation. However, the experience of the past decade has suggested that the Phillips curve may have flattened somewhat, meaning less sensitivity of inflation to the output gap.

More concretely, we expect that very tight labor markets over the next few years will lead to high wage growth, which should create widespread inflation pressures. We project the unemployment rate to dip to an extraordinarily low 3% over 2022-24. These very tight labor markets will be necessary to pull formerly discouraged and marginal workers into the labor market, pushing labor force participation up to its potential. To be clear, this is just a one-time source of inflationary pressure, as once the marginal workers are in the labor market, their presence should be sticky. But it will be a prolonged process over the next several years.

Additionally, we think inflation risks are weighted to the upside, given the Fed’s willingness to let inflation run above its 2% long-run target for a while to make up for the fact it was below its 2% target for much of the 2010s.

Altogether, this means we forecast PCE (total and core) inflation averaging about 2.3% over the next five years. Given that the CPI usually runs about 30 basis points higher than the PCE, this implies 2.6% CPI inflation. This is fairly close to the 2.7% five-year break-even rate implied by Treasury Inflation-Protected Securities, which use the CPI.

We Expect Inflation to Moderately Exceed 2% After 2022

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)