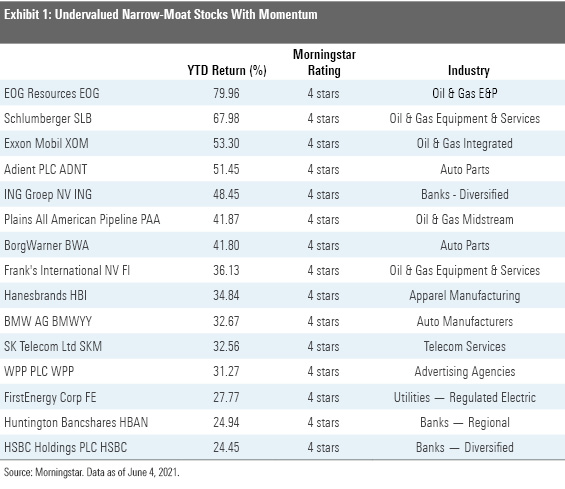

15 More Undervalued Stocks with Momentum

These narrow-moat names are all up twice as much as the market this year, yet remain undervalued by our metrics.

Last week, we took a look at stocks with a wide Morningstar Economic Moat Rating that were beating the market this year, yet still looked undervalued to us. Let’s keep the momentum going this week: We're expanding our view to include stocks that earn narrow economic moat ratings.

What’s the difference between a company with a wide economic moat and one with a narrow economic moat?

Both types of companies boast long-term structural advantages over their competitors, and those advantages allow them to successfully fend off competition. Those companies that we think can keep competitors at bay for 20 years or more earn wide economic moat ratings; those we think can do so for a decade or more earn narrow economic moat ratings.

Dig deeper: Morningstar's Guide to Stock Investing

Specifically this week, we screened for narrow-moat stocks that have returned more than twice as much as the overall market this year; the overall market has returned nearly 12%, based on the Morningstar US Market Index as of this writing. We then winnowed down the list to those names trading at 4- or 5-star levels. Fifteen stocks made the cut.

Here's a little more about three names from the list.

Schlumberger SLB "Among oilfield-services companies, Schlumberger has long stood in a class of its own. Underpinned by its moat and strong management, the company has earned solid economic profits for decades. It reached the front of the pack in wireline evaluation in the 1920s, and it hasn't relinquished its position since. Since then, Schlumberger has used its unrivaled expertise in understanding oil and gas reservoirs to not only drive a continuous stream of profits in its legacy business lines (embedded in the reservoir characterization segment), but also develop other oilfield-services business lines with nearly unwavering success. As one of many examples, the company pioneered directional drilling in the mid-1980s, a technology that today is recognized as an indispensable ingredient in the shale revolution.

Schlumberger is now applying its expertise to a somewhat different strategic focus: lowering the cost per barrel of oil and gas development via the provisioning of performance-linked services. Also, the company is prioritizing its digital capabilities, which will further support its capacity to boost efficiencies for Schlumberger and its customers.

This cost-cutting focus puts Schlumberger in an ideal position as oil producers globally are seeking to cut costs to cope with the era of lower oil prices ushered in by U.S. shale. In particular, international producers have struggled with rising costs for decades thanks to limited efficiency improvements. We think the success of Schlumberger in addressing this problem will drive market share gains in coming years.

We expect oil and gas capital expenditures to mount a resounding recovery from COVID-19, as we don't think the pandemic will have a major long-run impact on oil demand. In fact, we project global capital expenditures in 2025 to be up 15% versus 2019 (pre-pandemic) levels. This industry growth will lift up Schlumberger's financial results in coming years.”

Preston Caldwell, analyst

Adient ADNT "Adient is the automotive seating business of Johnson Controls JCI that was spun off to JCI shareholders in a taxable transaction Oct. 31, 2016. Adient leads the seating market with about 33% share globally. It is common for a spin-off to be ignored or misunderstood, but we think ignoring Adient just because it is an auto-parts supplier is shortsighted. Seating is one of the stickiest parts of the supplier sector since it is very difficult to take out an incumbent on a vehicle program, and automakers need suppliers that can consistently deliver high-quality seats in a just-in-time system all over the world. Automakers have global platforms and are willing to pay for the right supplier rather than the supplier simply with the lowest price. We think the seating sector can benefit from autonomous and electric vehicles rather than be hurt by the change because AVs and EVs open up new seating configurations and possibly more electronics content in seats.

We think some investors may need to reframe their perspective on seating and auto suppliers space by understanding that seating is not a commodity product and that firms such as Adient have a narrow economic moat with sustainable competitive advantages from three moat sources: intangible assets, switching costs, and cost advantage. It is normal in the seating space, for example, that an incumbent supplier gets the next generation of a vehicle program nearly 100% of the time.

Adient is in the process of consolidating some of its Chinese seating joint ventures so it can pursue business with more Japanese, German, and startup electric vehicle firms. We think the company can increase operating margin including equity income over the next several years by restructuring its operations to be a better manufacturer and asset sales of some Chinese joint ventures is giving good cash flow to reduce debt of about $3.6 billion. Management also formed a joint venture with Boeing BA in January 2018 focused on business-class seats, of which Adient owns 19.9%. For patient investors who can wait for the company to restructure itself, we see Adient as an interesting turnaround story capable of eventually generating good free cash flow.”

David Whiston, strategist

Hanesbrands HBI "Narrow-moat Hanesbrands is the market leader in basic innerwear (69% of its 2020 sales) in multiple countries. We believe its key innerwear brands like Hanes and Bonds (in Australia) achieve premium pricing. While the COVID-19 crisis adversely affected 2020 results, we think Hanes' share leadership in replenishment apparel categories puts it in better shape than some competitors. In May 2021, the firm unveiled its Full Potential plan to expand global Champion, bring growth back to innerwear, improve connections to consumers (through greater marketing and enhanced e-commerce, for example), and streamline its portfolio.

As part of Full Potential, Hanes intends to build on Champion’s increasing popularity in North America, Asia, and Europe. Although COVID-19 and the discontinuation of the C9 label at Target TGT hurt sales in 2020, we believe Champion will continue its growth path in 2021 as it and other activewear apparel have become more than just athletic apparel and are increasingly worn as lifestyle/fashion brands. Moreover, Hanes recently found a new home for C9 as an exclusive brand for wide-moat Amazon.com AMZN. Hanes’ management forecasts Champion will reach $3 billion in global sales in 2024, up from about $2 billion this year, which we see as an achievable goal.

Another key strategy for Hanes is to improve the efficiency of its supply chain. It has already made progress in this area, having achieved a 15% increase in manufacturing output over the past three years. Hanes, unlike many rivals, primarily operates its own manufacturing facilities. More than 70% of the more than 2 billion apparel units sold by the company each year are manufactured in its own plants or those of dedicated contractors. We believe the combination of strong pricing and production efficiencies allow Hanes to maintain operating margins above 20% for its American innerwear business despite somewhat inconsistent sales.”

David Swartz, analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JA7LQ2INFNFTZFBJLSDUZGIPJQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)