Is There a Retirement Crisis?

Potentially, if you don’t (or can’t) participate in a defined-contribution plan.

There’s long been talk of a looming retirement crisis in the US. However, our research suggests a more nuanced reality.

In our new report, my colleague Jack VanDerhei and I analyzed the likelihood that today’s US workers will have adequate financial resources in retirement using the new Morningstar Model of US Retirement Outcomes.

This new model aims to provide a comprehensive and realistic assessment of the retirement landscape. It features a sophisticated simulation framework, incorporating realistic investor behavior in the simulation. For example, savings rates are not static in our analysis. Instead, they vary based on various investor factors and plan features, reflecting the reality that investors do not maintain the same savings rate over the course of a lifetime of contributing to their retirement accounts.

We also reflect key postretirement considerations such as longevity risk, investment risk, and catastrophic healthcare costs into the analysis, simulating health states and retirement expenses, including those associated with long-term services and supports. The model integrates detailed household financial data from the Federal Reserve’s Survey of Consumer Finances into the analysis.

Defined-Contribution Retirement Plans Matter

Our most salient finding is that participation in employer-sponsored retirement plans significantly improved projected retirement outcomes.

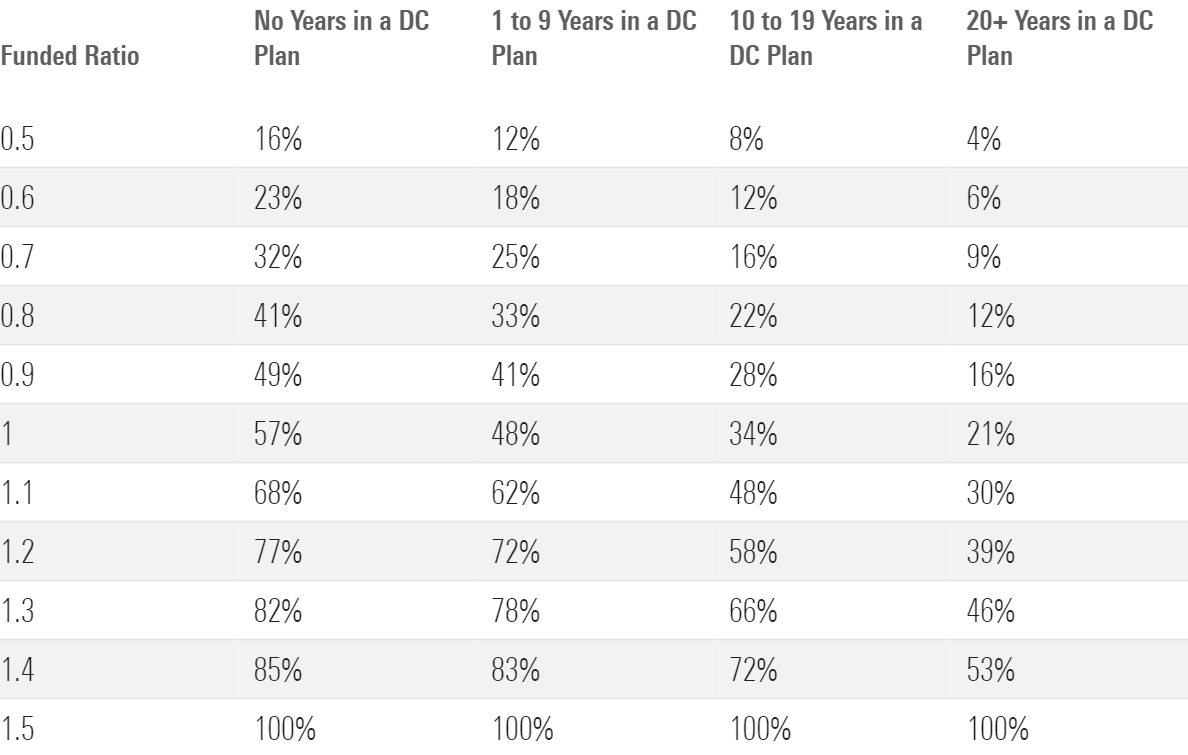

Specifically, we found that 57% of people not participating in a defined-contribution plan in the future may run short of money, compared with only 21% for those with 20 or more years of future participation in a defined-contribution plan. (Although, of course, people who contribute to a plan can still undermine their retirement by taking preretirement withdrawals or cashing out upon job termination.)

Results of this analysis are displayed below. Note that we are focusing on the results corresponding to a retirement-funding ratio less than 1. A ratio less than 1 indicates that projected income across all retirement years (the numerator of the ratio calculation) fell short of the projected expenses across all retirement years (the denominator in the ratio calculation)—that is, the lower the ratio, the less prepared the individual is for retirement. Note that we also incorporate bequests (that is, any leftover assets at the time of death) in the numerator of the retirement-funding ratio calculation, which is why ratios can be greater than 1.

Percentage of Gen Z, Millennials, and Gen X With Retirement-Funding Ratio Less Than Displayed Value by Number of Years of Future Participation in a Defined-Contribution Plan and Income Quartiles

Plan participation matters because Americans who participate in a defined-contribution plan are much more likely to save for retirement than workers who do not participate. For example, using the 2022 SCF, we noted that the average account balance (including retirement and nonretirement accounts, which refer to accounts where contributions are made on a post-tax basis) for Americans currently saving in a defined-contribution plan was about 4 times higher than for those who were not saving into a defined-contribution plan.

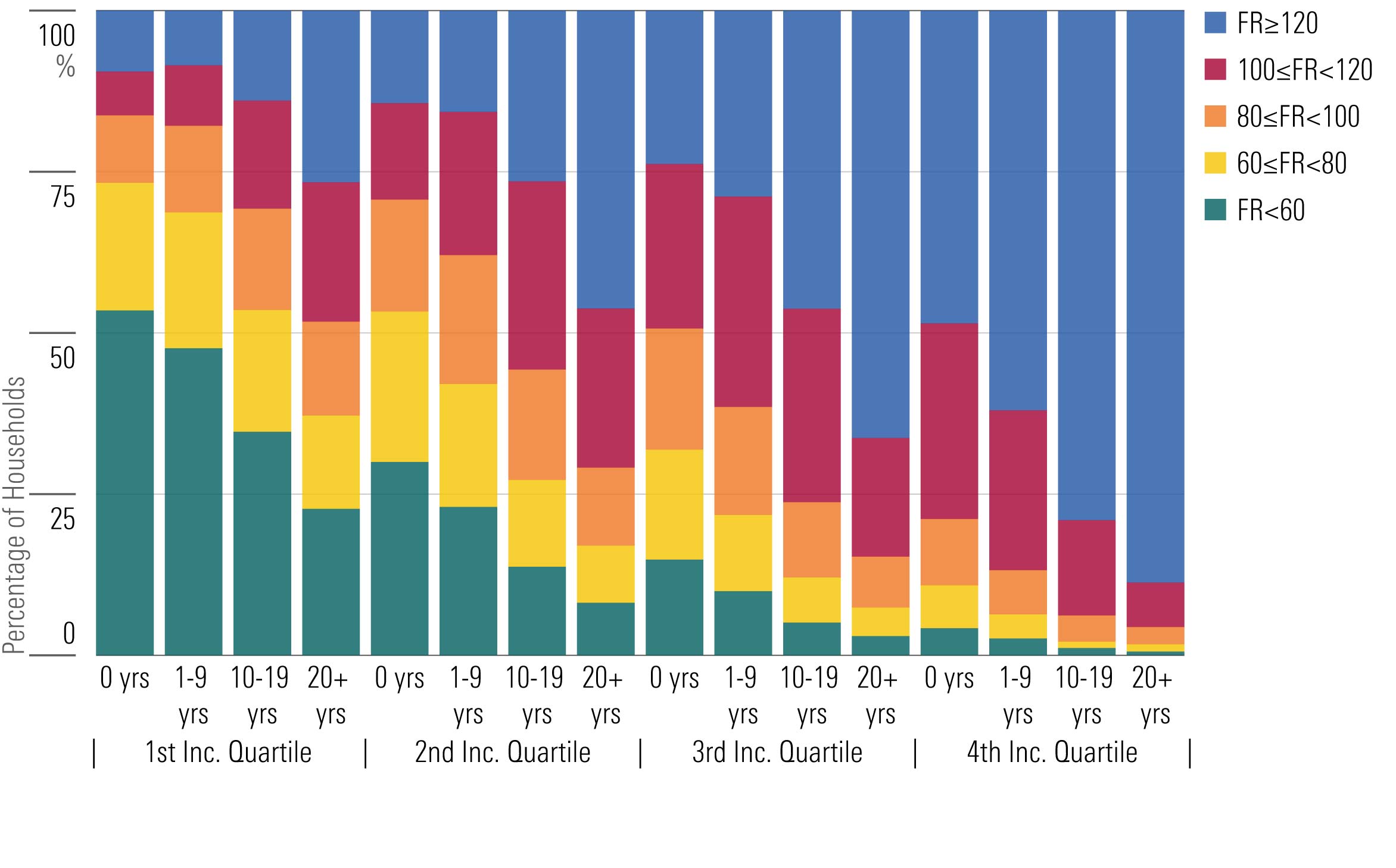

We also analyzed retirement funding ratios across income quartiles. We found that there is considerable dispersion in retirement outcomes, with lower-income workers much more likely to experience shortfalls.

Namely, almost 75% of households in the second-lowest income quartile with 0 years of future participation in a defined-contribution plan were projected to run short of money in retirement. However, retirement deficits for this income quartile were notably lower in cases in which household members were simulated to participate in a defined-contribution plan for 10 or more years. For example, focusing on the second income quartile, only about 28% of the households experienced retirement shortfalls when participating in a defined-contribution plan for 20 or more years.

This finding reinforces the point that policymakers and plan sponsors should focus on improving defined-contribution plan access and plan participation.

Percentage of Gen Z, Millennials, and Gen X With Retirement-Funding Ratio Less Than Displayed Value by Number of Years of Future Participation in a Defined-Contribution Plan and Income Quartiles

Long-term services and supports expenses are a big reason why lower-income households are so much more likely to experience retirement shortfalls. While we do project LTSS needs for higher-income households, there is not a significant impact on retirement adequacy because these households typically have sufficient assets to cover the costs. Lower-income households, however, do not have extra savings to cover health shocks, meaning that one or two years of LTSS can often deplete their savings.

We also analyzed retirement outcomes from a generational and race and ethnicity perspective. On the former, we found that baby boomers and Generation Xers are more at risk of retirement insecurity than later generations. And on the latter, we noted that Hispanic and Black Americans are much more likely to experience retirement shortfalls.

Future Research to Help Enhance Retirement Outcomes

The report underscores that participation in employer-sponsored retirement plans significantly enhances retirement outcomes. Workers without access to these plans face a higher risk of financial shortfalls in retirement.

The Morningstar Model of US Retirement Outcomes will serve as a baseline for future research. In particular, we plan on assessing the impact of legislative and regulatory proposals (such as changes to the Social Security regime) on retirement outcomes. We also plan on studying the effects of plan design modifications in order to help policymakers and employers make informed decisions to enhance retirement outcomes.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T6LOA5ZYUZEWPLNEAQHTZASGTY.png)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_dfa7464cdf714550aa17147bbf0892e9_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_f4bff959970341438335b5c352bbd465_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)