Is Your Retirement Plan Missing Out on Private Equity?

Private equity can enrich defined-contribution plans, but it also comes with concerns.

Should defined-contribution plans offer exposure to private equity? Some investment advisors are now adding the asset class to the target-date strategies offered in their defined-contribution plans—including alternatives such as private equity, private real estate, and more.

Take MissionSquare Funds, formerly Vantagepoint Funds, which offers retirement target-date and target-risk funds that include its Diversifying Strategies Fund. This strategy invests up to 70% of its assets in private alternative investments, while the other 30% is in liquid stocks and bonds. The alternative investments include real estate, private credit, and private equity.

MissionSquare Diversifying Strategies has performed well, albeit during a short historic period from which to assess, with its three-year annualized performance at 5.63% as of June 30, 2024. This was better than the performance of its benchmark, a blend of 60% S&P 500 and 40% Bloomberg US Aggregate Bond Index, which gained 5.38% over the same period.

This product is only available through the MissionSquare Retirement Target Funds, where it constitutes anywhere from 1% to 7% of the portfolio, depending on the time until retirement. Retirement investors’ overall exposure to private equity strategies is therefore relatively small, minimizing the risks as well as the challenges around liquidity, valuation, and operation.

To date, these strategies have primarily been made available to public sector employees through 457 plans and have yet to achieve broader adoption into private defined-contribution plans. Indeed, broader adoption can be both appealing and challenging.

In our research paper, we examine how private equity investments could help and hinder retirement plans.

The Case for Private Equity in Defined-Contribution Plans

Including private equity in a defined-contribution plan offers several advantages.

MissionSquare has stated that it wants to offer alternatives in retirement plans because of their potential to deliver better risk-adjusted returns than traditional stocks and bonds while providing diversification to an overall investment portfolio. Including private equity could enrich defined-contribution plans, especially given private equity’s growth and its potential to yield higher returns.

The arguments for private equity in defined-contribution plans are strengthened by the time horizon of most plan participants and the shift seen in the retirement industry over the past few decades. Consider:

- Defined-contribution plan participants are saving for retirement, which is often more than a decade away. This longer time horizon better lends itself to investments in asset classes with less liquidity (such as private equity) than accounts where investors are saving for nearer-term goals.

- Pension plans have become less common over time, while defined-contribution plans have become more prevalent. As a result, more retirement savings are concentrated in defined-contribution plans than pension plans. Given the historic investment in private equity by pension plans, the shift to defined-contribution plans raises the question of whether private equity is a useful investment to include in these plans.

The MissionSquare Diversifying Strategies Fund is a sign that investment firms are starting to expand defined-contribution plans to include private equity. Yet despite this development, private alternatives are still uncommon in the bulk of defined-contribution plans.

The Concerns Curtailing Adoption of Private Equity

Recent research from Cerulli showed that more than half of defined-contribution investment-only asset managers had no plans to offer private alternatives.

Cerulli suggests that private alternatives are not yet compatible with defined-contribution plans because of their illiquidity and opaqueness. These challenges present obstacles to fiduciaries looking to include private equity in 401(k) lineups and target-date funds. According to Cerulli, many firms are concerned that people will see private alternative funds like MissionSquare’s as overpriced or too volatile.

Investment firms are also still concerned with the legal challenges of including private equity in defined-contribution plans, especially as it relates to the fiduciary duty mandated by the Employee Retirement Income Security Act. Plan sponsors for defined-contribution plans that offer private equity must meet a very high bar to satisfy their prudential duty under Erisa. This is a tall order, and the cumbersome nature of taking on private alternatives has created an environment of hesitancy.

With the disclaimers that MissionSquare provides, it’s easy to see why such a fund might scare off potential investors. Yet there is another challenge that firms like MissionSquare face when building these private alternatives products: finding the right private equity funds for retirement portfolios.

What We Found in Pension Plans

To assess whether private equity enhances retirement investment outcomes, we analyzed historical allocations to private equity and subsequent returns within pension plans.

As detailed in our research paper, there appears to be no consensus on the correct private equity allocation percentage, and there is no single approach that would be broadly applicable to defined-contribution plans.

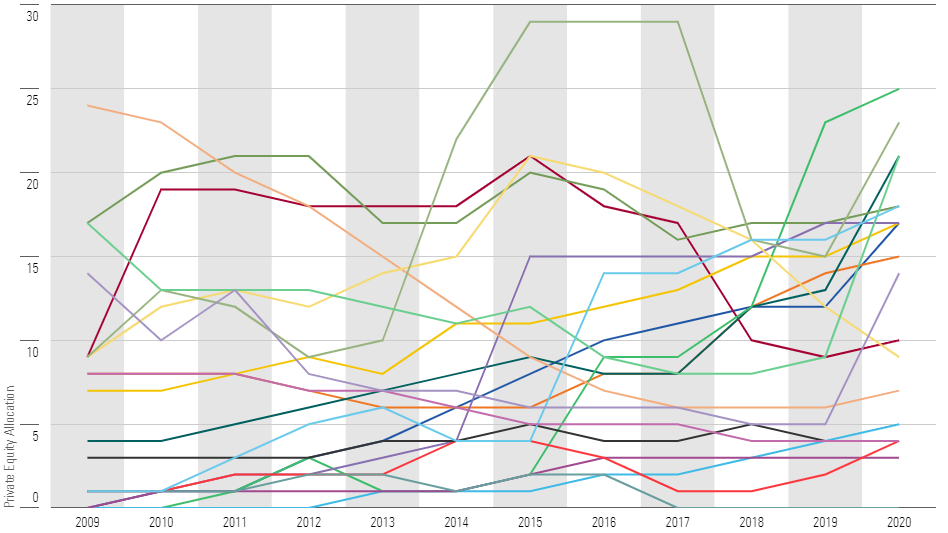

We found a wide range in how firms allocate private equity. Our analysis shows that pension plans’ diverse private equity allocation strategies are characterized by substantial fluctuations each year. Plan managers seemed to select private equity allocations based on their own preferences, leading to a lack of uniformity.

The exhibit below demonstrates this. It illustrates the percentages that were allocated to private equity from 2009 to 2020 for the 20 largest pension plans that offered some level of exposure.

Allocation to Private Equity by Year—Largest Plans

But where we did find some consensus was in the fund families that pensions preferred to invest in. Returns on pension plans that included private equity funds displayed similar inconsistencies, implying that plan managers had no special skill regarding selection.

The lack of uniformity in pension plans’ private equity investments presents a real challenge for defined-contribution plans in terms of providing a road map. In the absence of a universally consistent approach to private equity investing, it’s vital to educate investors in defined-contribution plans that offer private equity on the risks of this asset class. Transparency, disclosure, and careful selection of fund managers are paramount to protecting investors.

Enhancements to data filed with the Department of Labor through Form 5500, as we have previously advocated, would go a long way toward improving our ability to assess the inclusion of private equity in defined-contribution plans. As private alternatives geared for defined-contribution plans like MissionSquare’s offerings come to market, the list of successful examples increases. With more data available, employers and plan managers will have an increasing number of tools available to them to help them meet their fiduciary duties under Erisa. This is only the beginning.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/7f371608-2d27-4469-b930-95e72237b6e9.png)

/s3.amazonaws.com/arc-authors/morningstar/f3c31470-cc00-45ac-b20f-d2928ec12660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T6LOA5ZYUZEWPLNEAQHTZASGTY.png)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_dfa7464cdf714550aa17147bbf0892e9_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_f4bff959970341438335b5c352bbd465_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7f371608-2d27-4469-b930-95e72237b6e9.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f3c31470-cc00-45ac-b20f-d2928ec12660.jpg)