US Fund Flows: August Flows Dip Amid Volatile Equity Market

Equity funds slump, while fixed income shines.

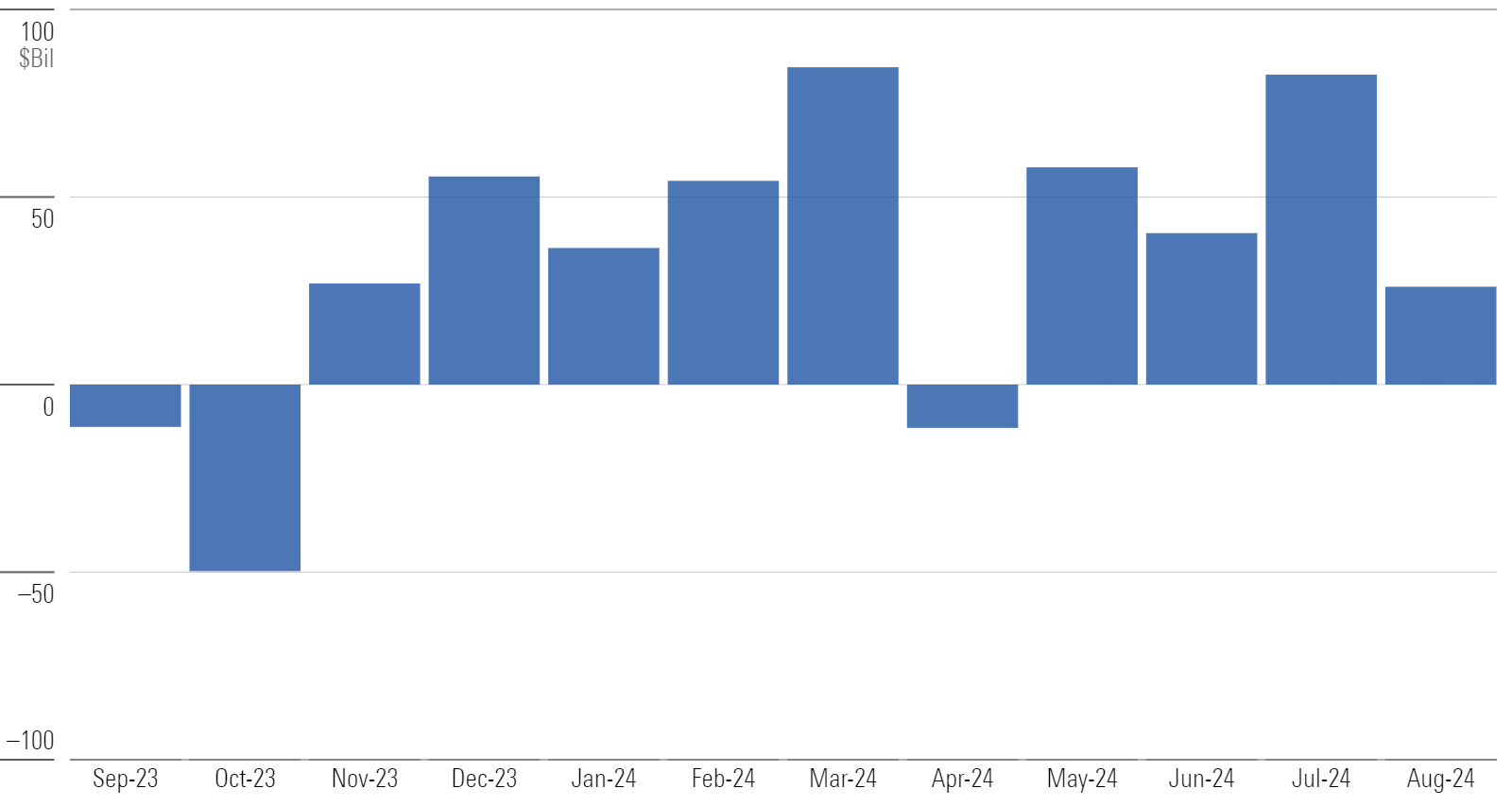

US funds gathered just $26 billion in August 2024, their lowest total since April. Two of the three equity category groups suffered outflows, while the third was relatively flat. Flows into fixed-income funds and alternatives propped up the overall picture.

US Fund Flows

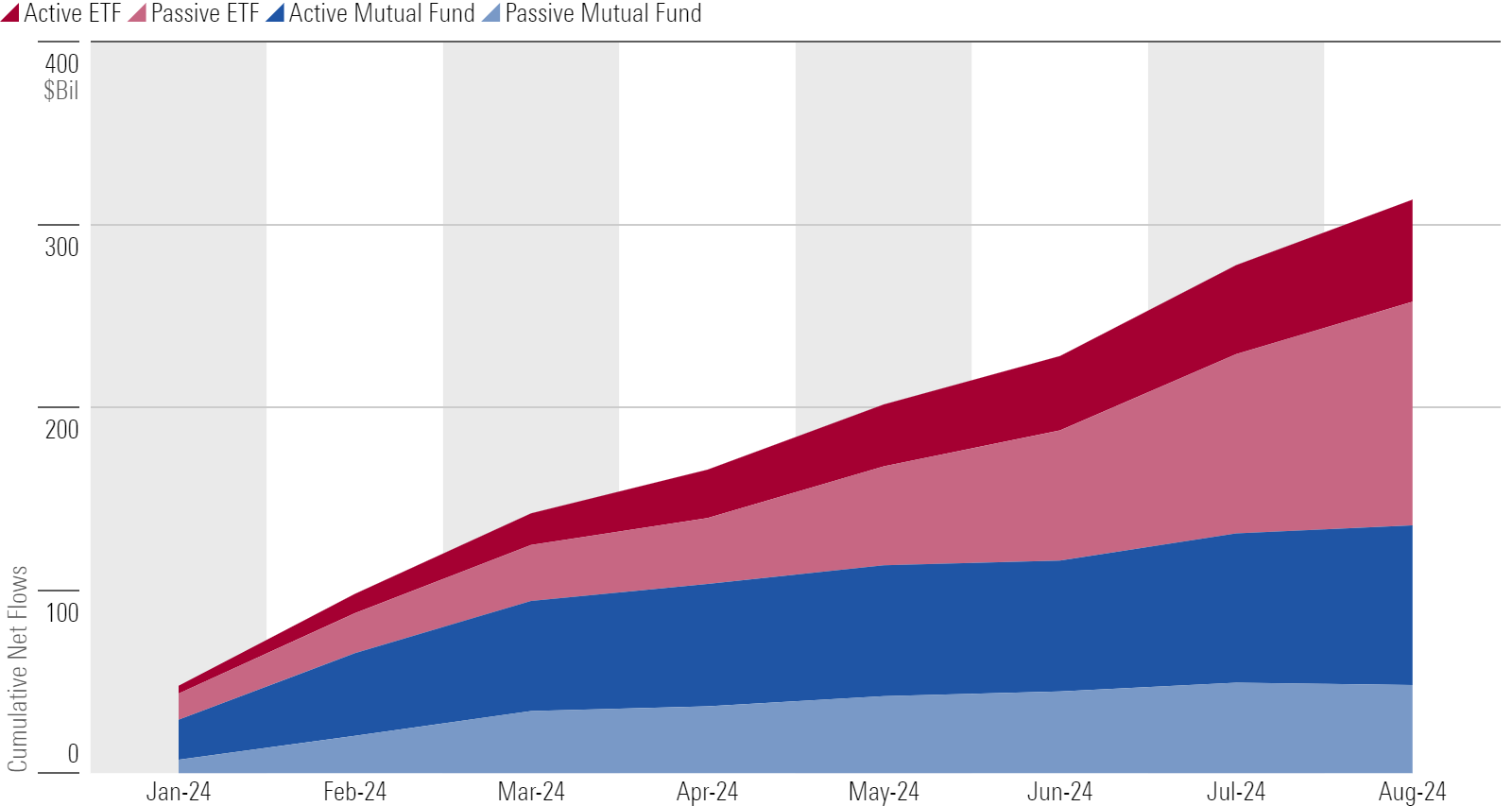

Broad Demand for Taxable Bonds

Taxable-bond funds pushed their 2024 inflow over $300 billion after collecting $33 billion in August. Investors have piled into taxable-bond products of all stripes: active or passive, mutual fund or exchange-traded fund. That broad demand has helped taxable-bond funds expand faster than the equity category groups, where outflows from active mutual funds have been hard to offset.

Taxable-Bond Flows by Vehicle

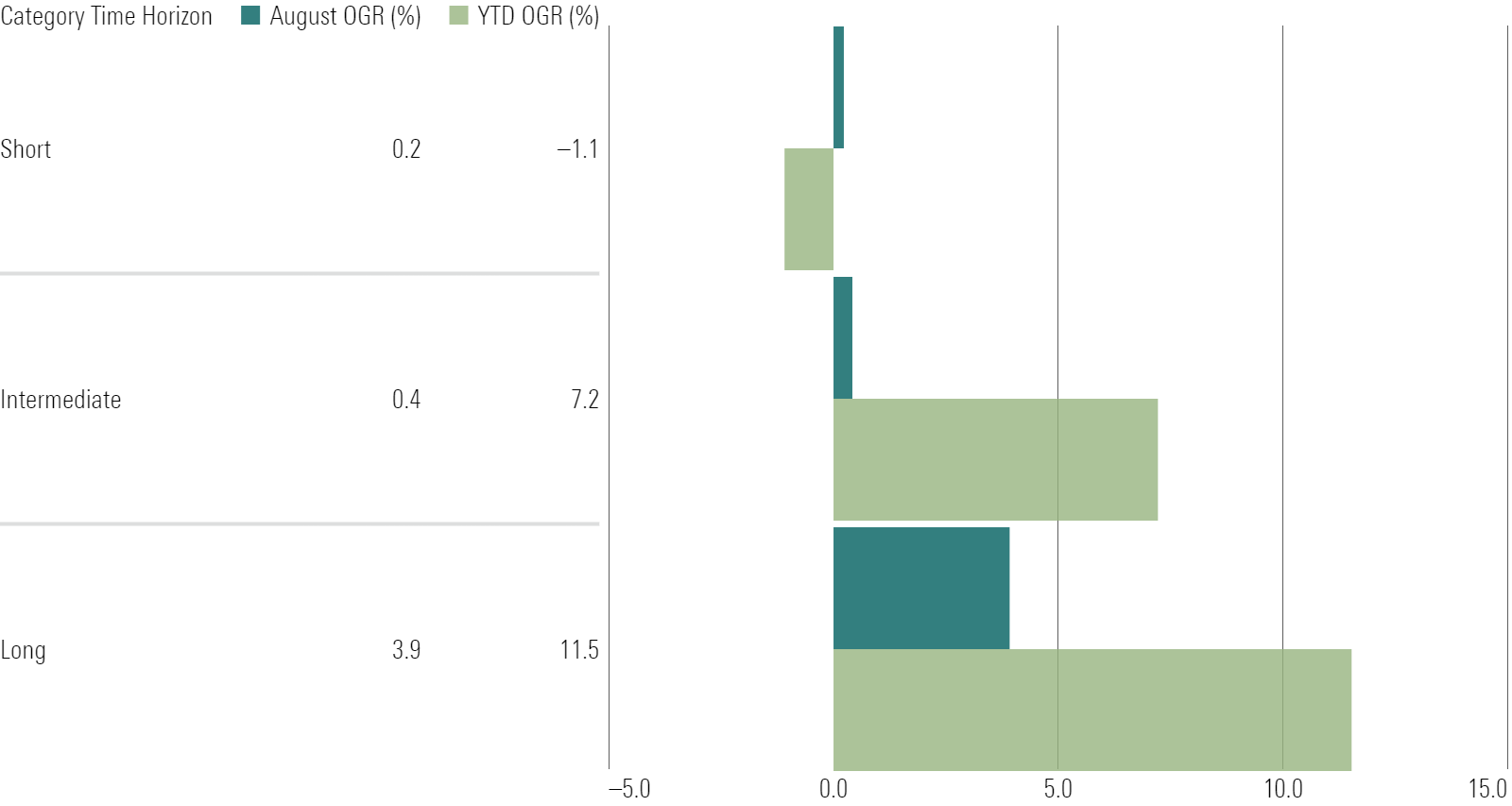

Imminent Rate Cuts Guide Bond Flows

Investors have positioned for lower interest rates for most of this year. That was especially true in August when fresh economic data looked like surefire evidence that the Federal Reserve would cut interest rates in September. Long government-bond funds are sensitive to rate changes and raked in $7 billion, while bank-loan funds often used as inflation hedges endured nearly $5 billion of outflows.

Taxable-Bond Organic Growth Rates by Time Horizon

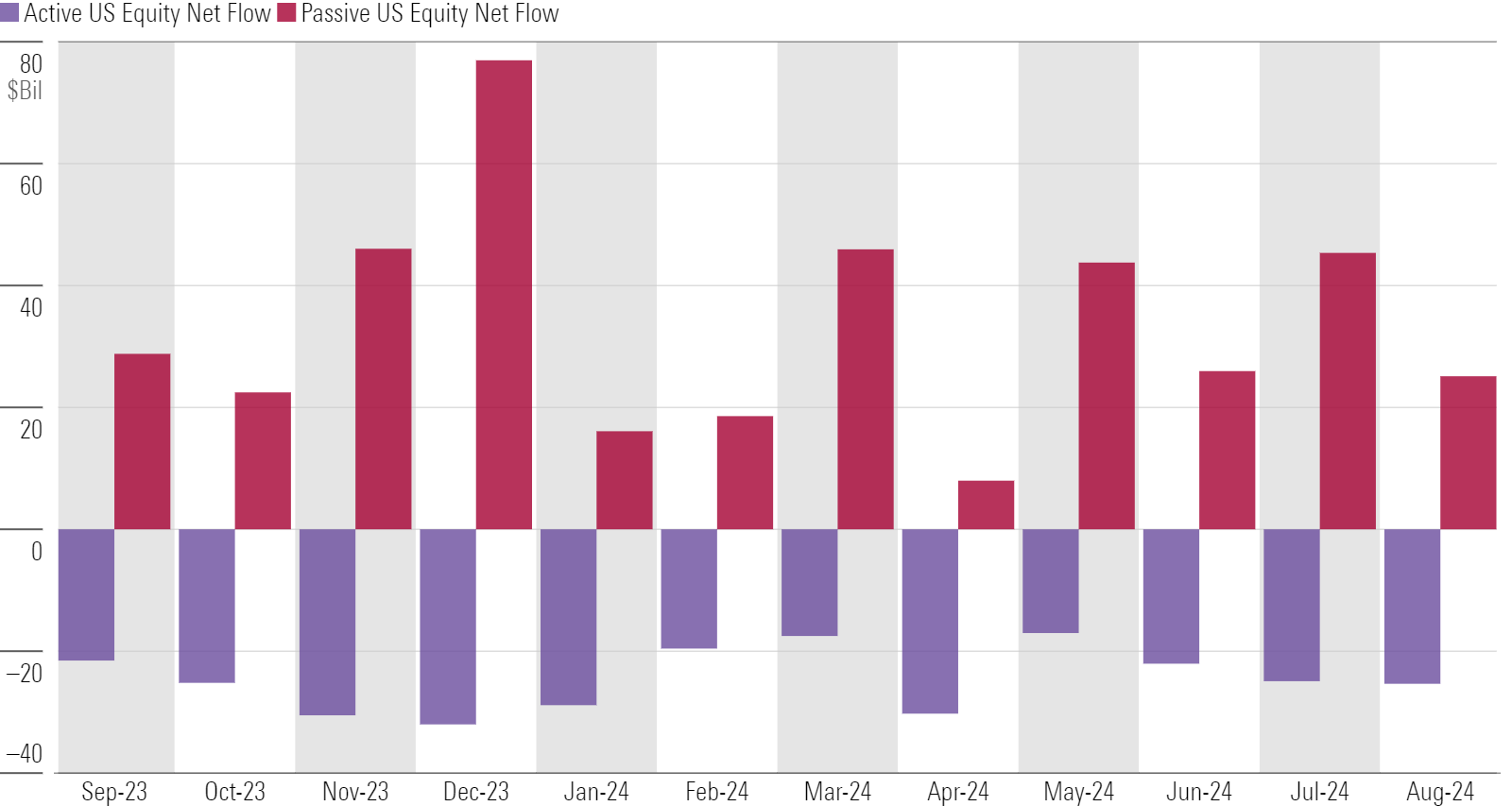

US Equity Flows Post Flat Month in August

Outside of the usual flows into passive large-blend funds, US equity funds didn’t have much else going for them in August. The category group posted near-flat net flows thanks to outflows from six of the nine Morningstar Style Box categories, while mid-cap blend and small-value funds posted minor inflows. Passive funds in categories other than large-blend generally had subpar months relative to their pace so far in 2024.

US Equity Flows

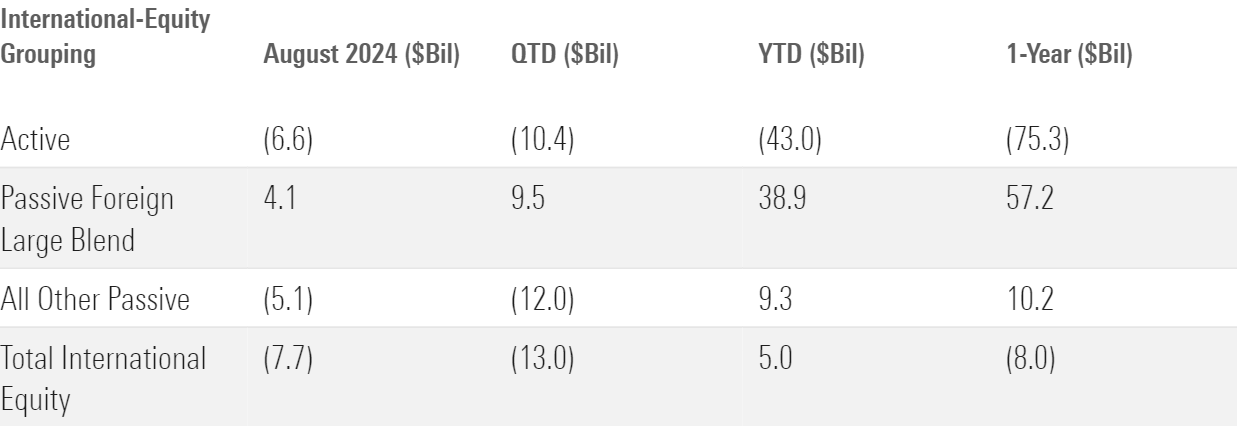

International-Equity Funds Stumble in August

This troubled category group just posted its worst absolute outflow and organic growth rate in 2024, and the second worst since the start of 2023. Investors pulled nearly $8 billion from international-equity funds in August. Fifteen of the 19 categories in the group suffered outflows. Passive international-equity funds saw about $1 billion leave, marking two consecutive months of outflows—a rarity over the past decade.

International-Equity Flows

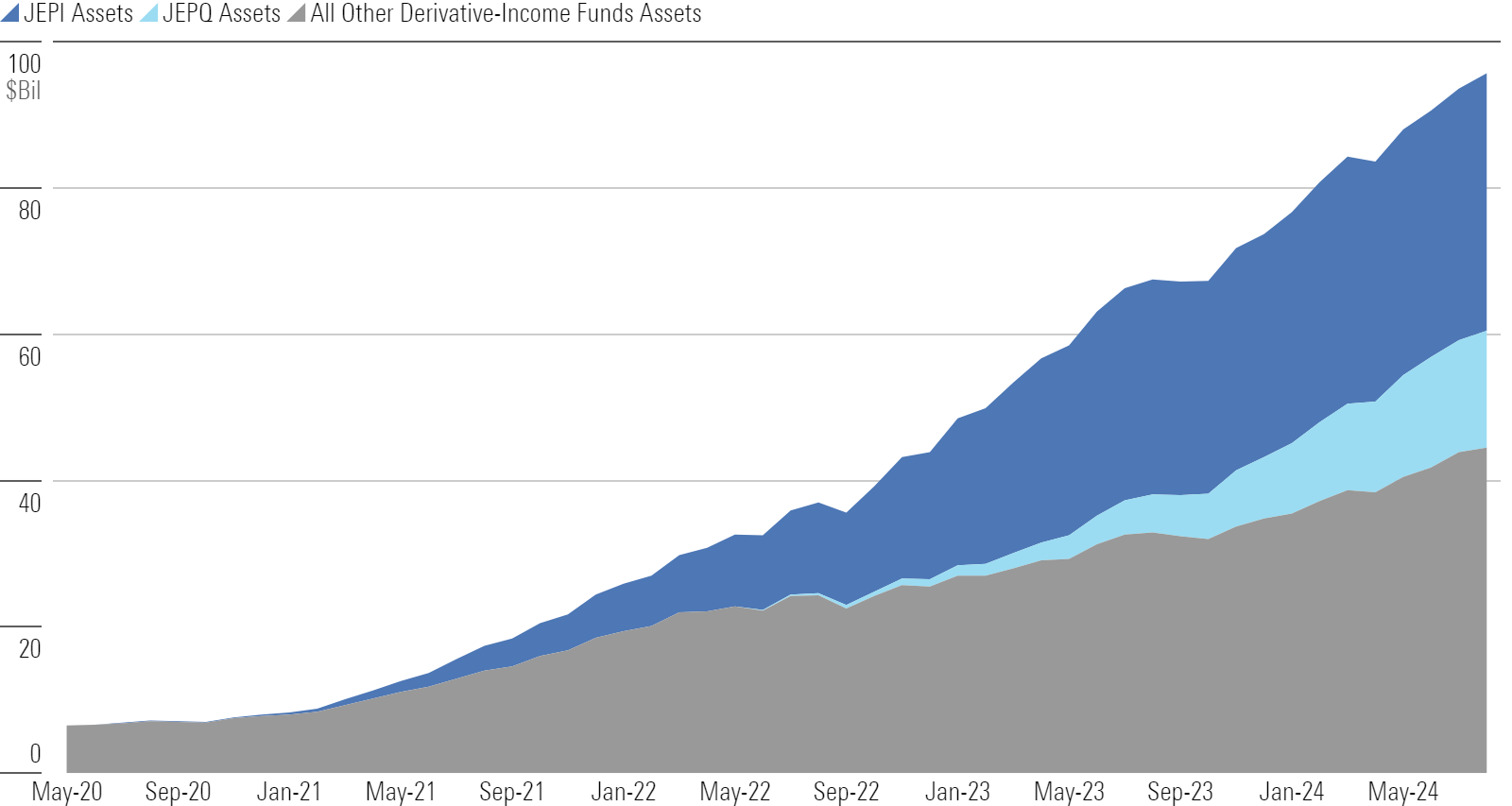

The End of an Era: JEPI Flips to Outflows

Nontraditional stock funds saw modest inflows, but JPMorgan Equity Premium Income JEPI was not one of them. August concluded the $35 billion behemoth’s streak of inflows dating back to its May 2020 inception. However, JPMorgan Nasdaq Equity Premium Income JEPQ has raked in more than $7 billion for the year and totals $16 billion itself.

Derivative-Income Flows

This article is adapted from the Morningstar Direct US Asset Flows Commentary for August 2024. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)