Better Labeling for ETPs Long Overdue

Investors would benefit from greater clarity and consistency in exchange-traded product labeling.

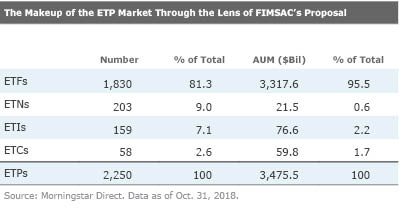

Not all exchange-traded products, or ETPs, are created equal. But oftentimes, investors unwittingly treat them as though they are. There are important differences in how different types of ETPs are structured as well as the exposures that they provide. Investors need to be aware of these differences. A recent proposal put before the SEC calls for clearer and more consistent labels for various categories of ETPs. I believe that better labeling is long overdue and would help investors to more confidently navigate the menu of more than 2,250 ETPs.

Today: ETFs + ETNs = ETPs

At present, ETPs generally fall into one of two buckets. The first contains exchange-traded funds. ETFs represent the majority of ETPs by count and the lion's share of assets. Thus, its unsurprising that "ETF" has often been used as a catchall term in much the same way that Kleenex is used to refer to all facial tissue. Most ETFs are mutual funds, subject to the same rules and regulations as traditional mutual funds. A handful, including the granddaddy of them all,

The second bucket of ETPs contains exchange-traded notes, or ETNs. Notes are not funds. They are, in effect, IOUs written by banks. These IOUs trade on a stock exchange. In the case of ETNs, the issuing bank promises to deliver the return of an index to investors in exchange for a fee. These notes do not directly hold the securities that make up their underlying index, and they may or may not be backed by collateral that would protect investors in the event the issuing bank were to default. Thus, ETN investors are subject to credit risk--the risk the issuing bank will go bust. Also, the terms of the note tend to favor the bank. Most notably, the banks backing these notes can (and have) call off the bet they are making in the event the costs of keeping them become too great.

What's Been Proposed to the SEC The SEC Fixed Income Market Structure Advisory Committee's (FIMSAC) Subcommittee on ETFs and Bond Funds recently submitted a proposal that would create greater granularity, consistency, and clarity in ETP labeling. The proposed taxonomy is the spitting image of one previously put forth by BlackRock, sponsor of the iShares range of ETFs. Indeed, Ananth Madhavan, the firm's global head of research for ETFs and index investing is a member of the FIMSAC subcommittee that proposed this measure. Thus, it is no surprise that the firm is using this venue to make its case.

The firm's advocacy of this new framework could be construed as inherently self-interested--and I'd argue that's absolutely the case. As the largest global sponsor of ETFs, BlackRock/iShares has a clear interest in defending the ETF "brand." But I would also argue that this measure would be in investors' best interests as well. Investors would be better-served by a clearer set of standards and expectations as to what they can expect from an ETF, as well as other types of ETPs.

Tomorrow: ETFs + ETNs + ETIs + ETCs = ETPs? The new labels put forth in the proposal sitting before the SEC would introduce a pair of new buckets to further sort ETPs. The two new groupings would be exchange-traded commodities, or ETCs, and exchange-traded instruments, or ETIs.

The ETC grouping would include the various legal structures, like grantor trusts, that are not registered investment companies. These products seek to deliver investors the performance of a commodity or basket of commodities using futures contracts or by way of owning the physical commodity. ETNs offering commodity exposure and products offering leveraged or inverse exposure would be excluded from this grouping. Isolating this cohort and labeling them ETCs would allow investors to more readily group ETPs offering exposure to commodities.

Incremental to applying the ETC label, I believe it would be useful to investors to require standard disclosures around how these products achieve exposure to the underlying commodity or commodities. Investors should be able to readily ascertain whether these products own physical commodities or achieve commodity exposure through futures contracts.

ETIs, like ETFs, are registered investment companies. However, these funds offer leveraged or inverse exposure to their underlying benchmark. We have long taken a dim view of these products . While these funds have generally performed as they should, many investors' expectations of how they should perform have often been miscalibrated.

In response to their widespread misuse, the SEC instituted a moratorium on these products in March 2010. Since that date, it has deferred its review of exemptive-relief requests for similar products, though existing issuers have been able to continue to bring new leveraged and inverse funds to market. In recent years, many of these products have been banned from platforms' fund menus, and in other cases, investors need to explicitly acknowledge that they understand the risks inherent in investing in them before being allowed to trade them.

While ETIs are technically funds, I believe that applying a distinct and more explicit label to this group to call attention to their unique features would further protect investors against potentially misunderstanding and misusing them.

A Package Deal This naming proposal has been put before the SEC while it is reviewing comments to its proposed ETF Rule, which seeks to harmonize the rules of the road governing the way ETFs are structured and managed and provide investors more data to inform their investment selections. (You can find Morningstar's comment on the proposed ETF Rule here.) More than 25 years after the introduction of the first U.S. ETF, a standard set of rules and naming conventions is long overdue--but better late than never. I think the measures proposed by the SEC within the ETF Rule are largely favorable for investors to the extent that they would result in greater consistency and clarity with respect to how these funds are managed and the amount and type of data they are required to disclose. I believe that providing a similar degree of clarity and consistency in ETP labeling is a necessary complement.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)