Better Bond ETFs?

A new crop of rules-based bond ETFs is attempting to improve on traditional market-cap-weighted alternatives.

A version of this article was published in the June 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

There's a lot to like about market-cap-weighted bond index funds. They offer low fees, a consistent and transparent approach with no key-manager risk, and low transaction costs because they favor the most-liquid issues and have fairly low turnover. But market-cap weighting may not be the optimal way to construct a bond portfolio because it tilts toward the most heavily indebted issuers. The implications of this are different in the investment-grade and high-yield market segments. In the investment-grade market, cap-weighting skews most portfolios toward low-yielding Treasuries and agency mortgage-backed securities, dragging down expected returns. In the high-yield market, the biggest debtors may have particularly high credit risk.

Several recently launched bond exchange-traded funds apply alternative screening and weighting approaches in an attempt to offer a better risk/reward profile than market-cap-weighted alternatives while retaining the benefits of traditional indexing. Each of these funds takes a distinctive approach and should be analyzed as an active strategy, even if it tracks an index. There are some promising candidates in this lineup, but they aren't all worthy of an investment.

Core-Bond ETFs The Barclays U.S. Aggregate Bond Index is a natural starting point for thinking about a core bond allocation,as it is built to represent the U.S. investment-grade bond market. Many active managers and ETFs tracking alternatively weighted indexes attempt to boost returns relative to the Aggregate Index by taking morecredit risk. This isn't difficult, as Treasuries andagency MBS jointly represent over 60% of the index.

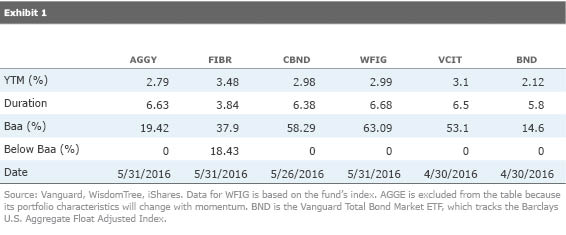

WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield ETF AGGY accomplishes this by reweighting the constituents of the Aggregate Index. It divides the benchmark into 20 subcomponents based on maturity (short, medium, and long term), credit quality, and sector (government, corporate, and securitized). Each month it reweights the subcomponents to maximize yield, subject to a few constraints. These include limiting tracking error relative to the parent index to 35 basis points each month, capping its sector tilts and allocation to lower-credit-quality subcomponents at plus or minus 20 percentage points of their levels in the parent index, and limiting turnover. Additionally, the fund's duration cannot be more than a year greater than that of the parent index.

The end result is a modest pickup in yield relative tothe Aggregate Index, greater exposure to lower-quality(A and Baa rated) debt, and slightly greater interest-raterisk. Overall, this fund is a compelling option forinvestors who want a little more return and arewilling to take a little extra risk to get it--especiallyas it charges a very attractive 0.12% expense ratio.

IQ Enhanced Core Bond U.S. ETF AGGE (0.34%expense ratio) takes a more aggressive approach toboost returns. It applies a trend-following momentumstrategy within five segments of the investment-gradebond market, including corporates, MBS, andshort-, intermediate-, and long-term Treasuries.This is based on the well-documented tendency forrecent performance to persist in the short term,which has been observed in every major asset class.A compelling explanation for this is that investorsmay under-react to new information, causing prices toadjust more slowly than they should. Once a trendis established, investors may extrapolate recent performancetoo far into the future and pile into the trade,further contributing to momentum.

While momentum has historically worked on paper,profiting from it in practice is a significant challengebecause it requires high turnover. This is particularlytrue in the fixed-income market, where transactioncosts tend to be far greater than in the equity market.To address this issue, AGGE is set up as an ETFof ETFs, which improves liquidity and reduces thenumber of required transactions.

The trend-following signal it uses is based on a 45/90-day moving average. When each of the five segments'45-day moving average price exceeds its 90-daymoving average, the fund gives an overweighting tothat sleeve relative to the Aggregate Index or anunderweighting when the opposite is true. This is ashort-term signal compared with those that traderstypically apply in the equity market, but Index IQ(the creator of the fund's methodology) found that itworked better in the fixed-income market. Thefund adjusts its segment tilts based on the segment'svolatility. More-volatile sectors get smaller over- orunderweightings, respectively. It also sizes its bets bythe magnitude of each segment's momentum. Theindex limits each segment tilt to plus or minus 30 percentagepoints of its weighting in the AggregateIndex. However, no sector may account for more than50% of the portfolio, and there is no shorting. Thefund is rebalanced monthly.

This is an interesting strategy, but there is a risk thattransaction costs may erode the benefit from itsmomentum exposure and that the signal it is using maybe too short. Only time will tell whether it is able toprofit from momentum in practice. This fund is worthwatching, but I'm not comfortable with it yet.

More Credit Risk Where AGGE attempts to profit from behavioral biases, iShares Edge U.S. Fixed Income Balanced RiskETF FIBR attempts to boost return by taking on morecredit risk, extending its reach into high-yield territory.This actively managed fund is distinct because it attempts to take on identical amounts of credit andinterest-rate risk to improve diversification (think of itas a type of intra-asset-class risk parity approach).In contrast, interest-rate risk dominates the AggregateIndex and investment-grade benchmarks like it.

This fund focuses on five segments of the bond marketthat have historically offered attractive risk/rewardprofiles including MBS, short- and intermediate-terminvestment-grade corporate bonds, BB rated high-yieldbonds, and high-yield bonds rated below BB. (Treasurieswere not eligible for inclusion.) There is not acompelling theoretical reason to expect these sectorsto continue offering more-attractive performance thanthe excluded sectors, like U.S. agency securities.

To achieve a balanced risk profile, the managers evaluatethe contribution of credit and interest-raterisk to each segment's performance during the past 24months and extrapolate those risk characteristicsinto the near future. If interest-rate risk exceeds creditrisk, the managers short Treasury futures to reduceinterest-rate risk and balance the risk contribution ineach sleeve. If the opposite is true, they take longpositions in Treasury futures. Finally, they weight eachsleeve so that it has an equal contribution to theportfolio's overall volatility and rebalance the portfoliomonthly. The resulting portfolio has a lower durationthan the Aggregate Index and greater exposure tolower-credit-quality borrowers, though more than 80%of the portfolio is currently invested in investment-gradesecurities. It also offers a higher yield to maturity.

The diversification of the fund's portfolio is its greateststrength, but there are some weaknesses. A sector'spast volatility and exposure to credit and interest-raterisk is not necessarily indicative of its future risk.For example, many MBS didn't look very volatile in theearly 2000s, but they still carried considerable risk,as investors later discovered. This strategy also requireshigh turnover, which could create meaningful transactioncosts that can erode its return. But it's one thatshould hold up better than its peers in a risingrate environment and is a reasonable long-term option.

Corporate Fundamental Weighting/Screening A few corporate-bond ETFs use issuers' fundamentalcharacteristics to screen out less-desirable securitiesor size positions. SPDR Barclays Issuer ScoredCorporate Bond ETF CBND (0.16% expense ratio) doesthis by assigning sector-relative scores to all eligiblepublicly traded investment-grade corporate issuers based on year-over-year changes in return on assets and interest coverage (EBITDA/interest expense). Forthe utilities sector, it substitutes current ratio (currentassets/current liabilities) for interest coverage. Largerpositive changes in these metrics are more desirable.

The fund sets its three sector weightings (industrials,financials, and utilities) equal to the Barclays CapitalU.S. Corporate Index, but within each sector it weightseach issuer according to its score relative to itssector peers. It rebalances back to these target weightingseach month and updates issuer weightingstwice a year. When an issuer has more than one qualifyingsecurity, the issuer's weighting is allocatedamong them pro rata based on their market value.

While the fund's weighting approach should tiltthe portfolio toward higher-credit-quality issuers, thiseffect appears to be modest. Most of its assetsare invested in Baa rated bonds. It offers a higher yieldthan the Barclays Intermediate U.S. Corporate Indexand comes with greater interest-rate risk. But this funddoesn't have a clear edge over market-cap-weightedalternatives with similar duration like Vanguard Intermediate-Term Corporate Bond ETF VCIT.

The same could be said of WisdomTree FundamentalU.S. Corporate Bond WFIG (0.18% expense ratio).It ranks publicly traded investment-grade bond issuersbased on return on invested capital, free cash flow/debt service, and total debt/assets, and it filters out thebottom 20% in each sector. This uses a more granularsector classification system than CBND, whichimproves comparability. The portfolio includes all theremaining securities but assigns larger weightingsto those with higher option-adjusted spreads (yields)and lower probabilities of default. Yet, at the end ofApril, it offered a comparable yield to maturity to VCIT,despite having greater exposure to Baa rated securitiesand similar duration. This suggests that WFIG'smore-complex approach doesn't necessarily yieldhigher expected returns.

Conclusion

- In their pursuit of higher returns, many alternatively weighted bond ETFs take on more risk (sometimes indirectly) than broad market-cap-weighted benchmarks. Investors should look beyond yield and make sure they are comfortable with the underlying risks.

- Greater complexity in portfolio construction isn't necessarily better. Alternatively weighted bond ETFs may incur high transaction costs and tracking error. And it may be possible to achieve similar exposure to alternatively weighted bond ETFs with market-cap-weighted alternatives that take comparable credit and interest-rate risk.

- AGGY is one of the more compelling alternatively weighted investment-grade bond ETFs available. FIBR is also a promising strategy, and AGGE is worth watching. But investors probably won't miss much by avoiding CBND and WFIG.

Disclosure: Morningstar, Inc.’s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RSZNI74R6FG7FDSWBUF6EWKDE4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)