The Implosion of Crypto, Nuclear Energy Investing, and How to Curb Overspending

We’ll review the top stocks, funds, and exchange-traded funds this week as well as updates you can make to your portfolio.

What You Missed

This week: Cryptocurrency exchange FTX collapsed; semiconductor stocks shone; investing in newly sustainable nuclear energy begins in the EU, and our investing specialists tell you how to inflation-proof your portfolio.

Chart of the Week

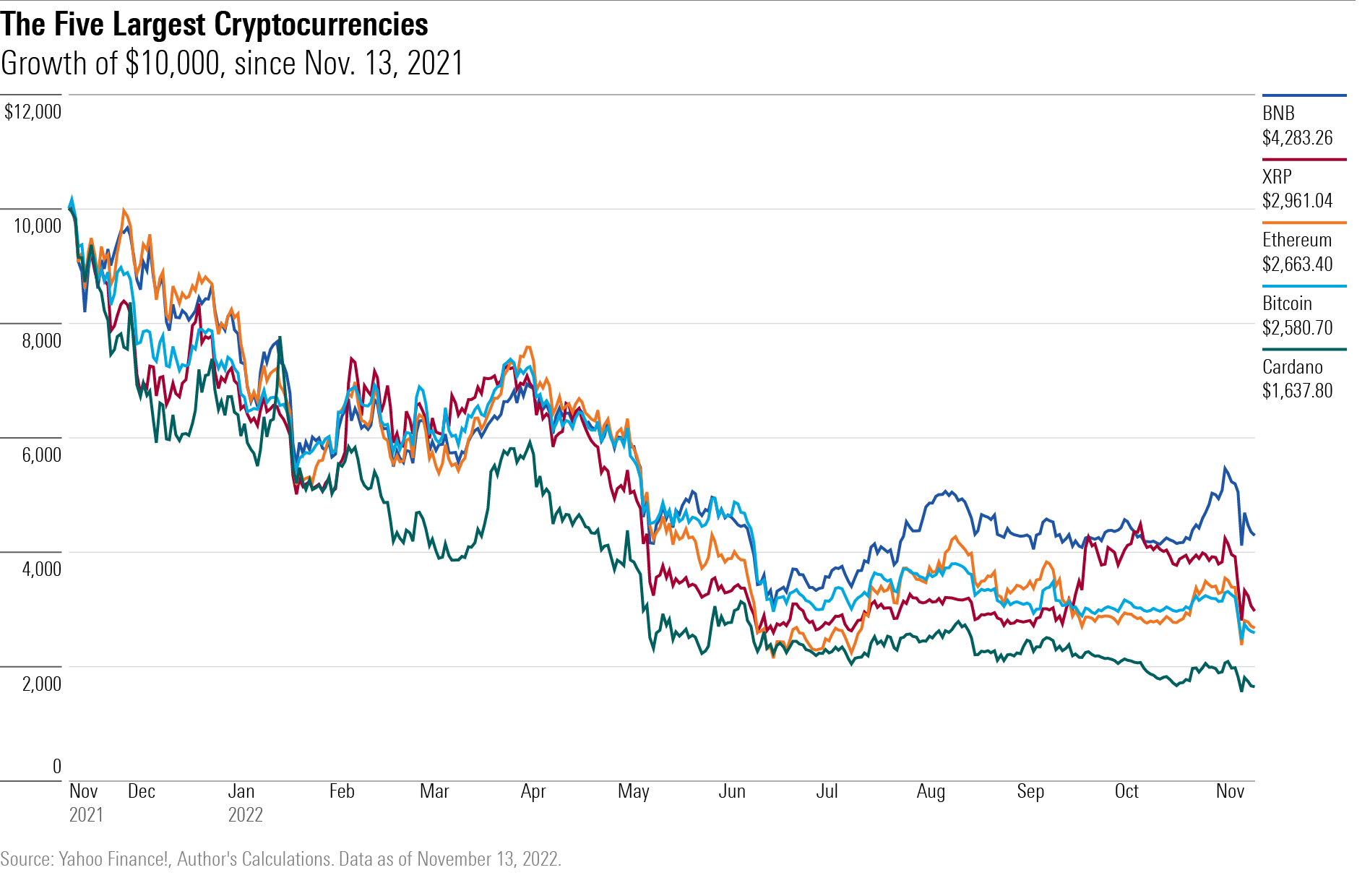

4 Lessons From Crypto’s Implosion

What potential buyers should know in the aftermath.

“What a difference a year makes. Twelve months ago, cryptocurrencies were all the rage. The Miami Heat had recently announced that its basketball stadium would be renamed FTX Arena, Fidelity was preparing to offer digital assets to the 401(k) plans that it administers, and a daft internet columnist wondered what could possibly “reverse bitcoin’s present course.” Read the full article from John Rekenthaler.

Glossary Term of the Week

Inflation

Inflation is the increasing price of goods and services over time, which reduces a currency’s purchasing power. See Morningstar’s Investing Definitions and Financial Terms for the full definition.

What to Watch

Is It Too Late to Inflation-Proof Your Portfolio?

Key Takeaways

- For people who are getting close to or are in retirement, they should be more concerned about preserving purchasing power.

- I Bonds can help hedge inflation but have built-in purchase constraints.

- Treasury Inflation-Protected Securities are a relative of I Bonds. They are issued by the U.S. Treasury and can help hedge inflation.

- If you want to maintain exposure to commodities, dribble the money in and plan to be a long-term holder of them rather than trying to get the timing exactly right.

Articles We Love

Got the Urge to Splurge? 4 Steps to Overcome Your Overspending Habit

Changing behavior takes time and repetition.

“Through time, study, self-awareness, and experimentation, I’ve replaced financial self-sabotage with habits of mind and behavior that make me both financially and psychologically better off. If you struggle with overspending, whether habitually or on occasion, I hope the process outlined here can help you make stronger choices that satisfy your desires without sabotaging your financial security.”

These mutual funds and ETFs earn Morningstar’s top rating.

Index funds are passive investments. They track an index with the goal of replicating the performance of that index, minus expenses. Active funds, meanwhile, are led by managers who choose particular securities in an effort to outperform an index.

The Benefits of Investing in Index Funds

Any historical performance advantage aside, there are several benefits to investing in index funds.

- Index funds are usually lower in cost than similar actively managed funds.

- Index funds perform like the market they’re tracking; as such, there aren’t many surprises in performance.

- Index funds don’t face what’s called key-person risk, which means that manager changes aren’t a big deal, since there’s no active security selection involved.

- Index funds are often more tax-friendly than similar active funds.

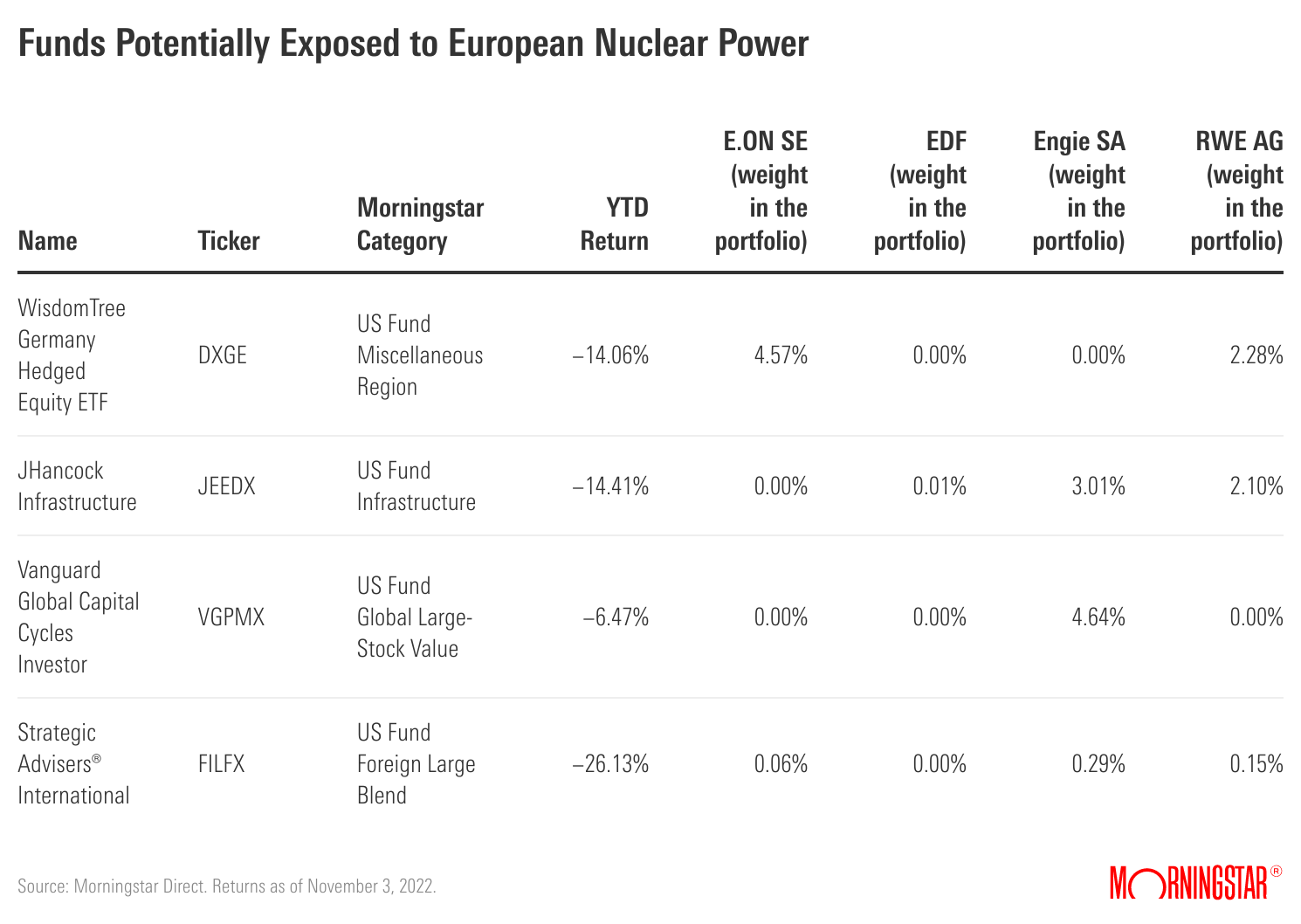

How to Invest in Nuclear Energy

A look at the companies, funds, and ETFs that could benefit from the move to nuclear energy, which doesn’t produce direct carbon emissions.

Stocks, Funds, and Exchange-Traded Funds

Top articles

5 Undervalued Stocks That Crushed Q3 2022 Earnings

Upgrade for a Vanguard Fund That Offers Inflation Protection

Is There a Right Way to Weight Stocks?

Missed Us?

Check out our investing specialists on Twitter:

“At some point it will probably be a wonderful time to buy crypto and some people will make a lot of money but there is almost zero way to know when that will be. And that’s the problem with crypto as an investment asset. The end.” - @Christine_Benz

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A5UY22L42ZASPAW6OW75IQHR2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SRXFRUTTFZGPPK6U6Y5EG4WGMY.png)