5 min read

Utilities Sector Outlook: Key Themes in 2025

A swoon in 2023 and a rally in 2024 raise considerations for this year.

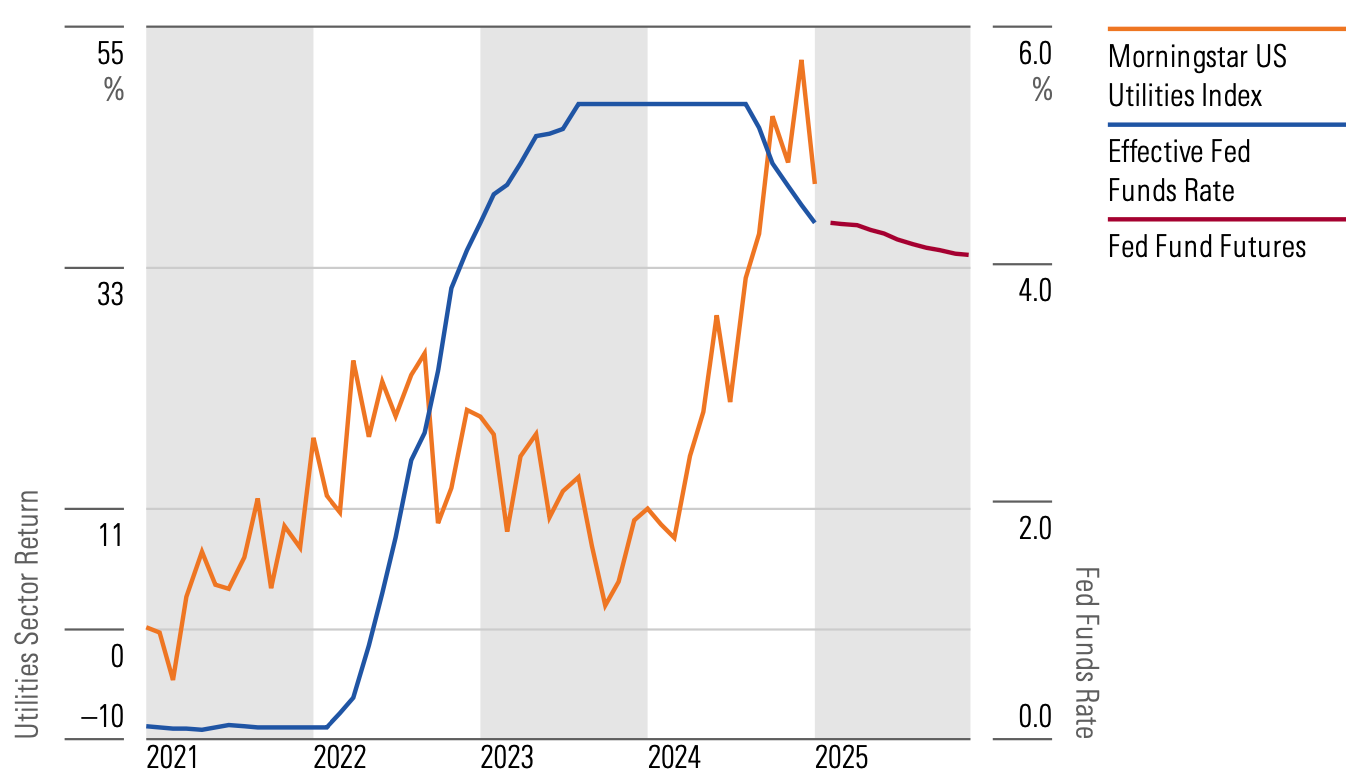

The utilities sector has experienced a rollercoaster of performance in the past. Still, 2025 may bring new opportunities and challenges. Excitement around lower interest rates has ebbed and our analysts believe valuations fully reflect AI-related energy demand growth potential. But risks include data center delays, an inflation rebound, and regulatory pushback on customer rate increases.

Given the evolving sector, financial advisors must stay informed on key themes to initiate valuable conversations and support clients. Our 2025 Utilities Outlook report analyzes the factors influencing each topic, their potential impact across different states and regions of the US, and more.

Data Centers

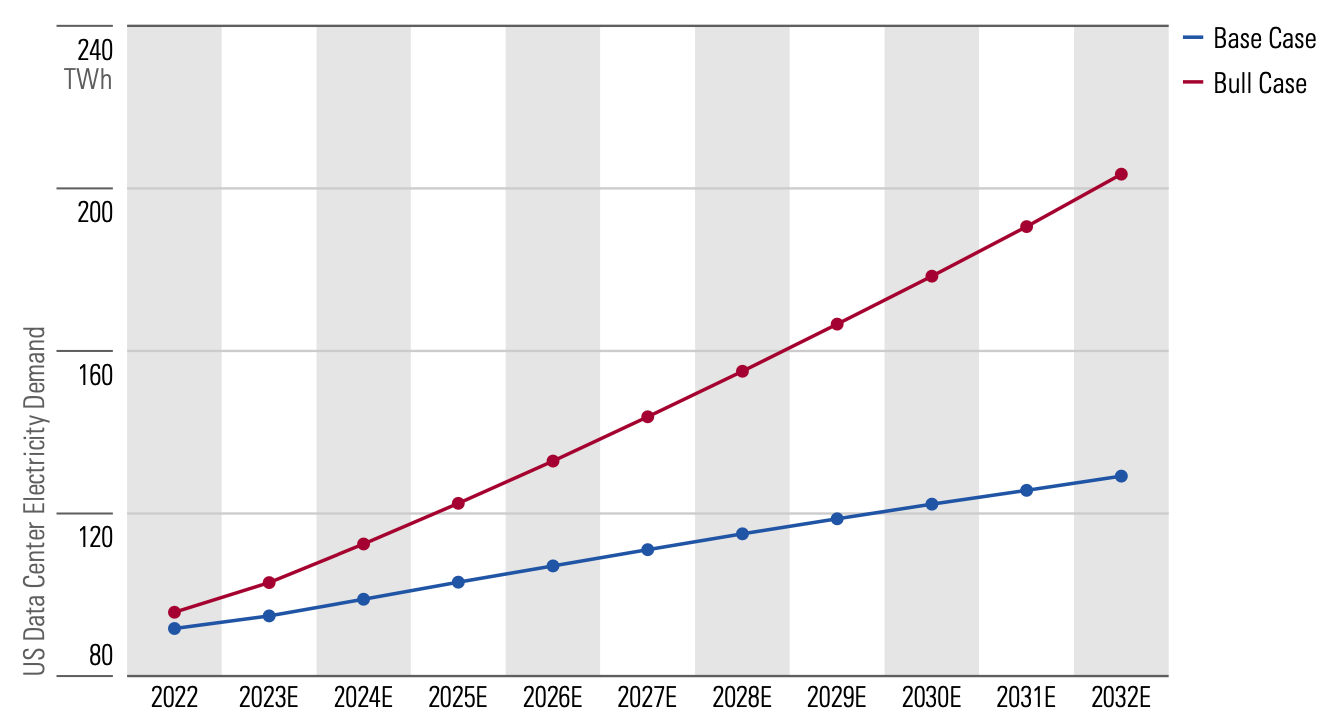

The AI craze helped power utilities' market-beating returns last year. Although our base case assumes data center electricity demand will represent 3% of US electricity demand, the outlook is trending toward our bull-case scenario—which has it more than doubling by 2032 and representing 4.5% of total US electricity demand instead.

US data center electricity demand is expected to more than double in our bull case.

However, we think the most bullish forecasts don't consider the challenges that utilities, regulators, and grid operators will face supplying the energy required to support new data centers.

Top energy constraints include:

Developing new energy infrastructure typically requires multiple layers of regulatory approvals, which will determine how quickly utilities can raise the capital necessary to complete growth projects.

Tight supply chains for large power generation and electrical equipment mean large, greenfield data centers may have to wait at least three years for new energy supply.

Utilities and grid operators must ensure grid reliability during peak demand periods before adding large data centers, possibly requiring additional infrastructure to meet that reliability standard.

Data centers that aim to use clean energy will require investment in energy storage, gas generation, and grid upgrades.

The Midwest US region, particularly states like Indiana and Wisconsin, also appear to be early leaders in attracting new data centers. This may not be surprising since developers are eyeing areas with cheap land, readily available energy, low natural disaster risk, and access to fiber networks.

Natural Disasters

Recent hurricanes and wildfires are reminders that natural disasters are a major operating and financial risk for all utilities. Restoring power, repairing infrastructure, and hardening the system against future extreme weather costs billions of dollars. Yet history suggests natural disasters don’t always destroy shareholder value—a market overreaction can sometimes create buying opportunities.

Hurricanes

Investors appear comfortable with the ability of most southeastern utilities to handle severe weather and seek regulatory recovery of restoration costs, even after some of the most destructive storms like Hurricane Helene last year. CenterPoint (CNP) was an exception to utilities successfully managing hurricanes' impact in 2024. Meanwhile, Hurricane Beryl—a mild Category 1 storm—affected more than 80% of Houston Electric's customers and resulted in as much as an estimated $1.8 billion in restoration costs.

Wildfires

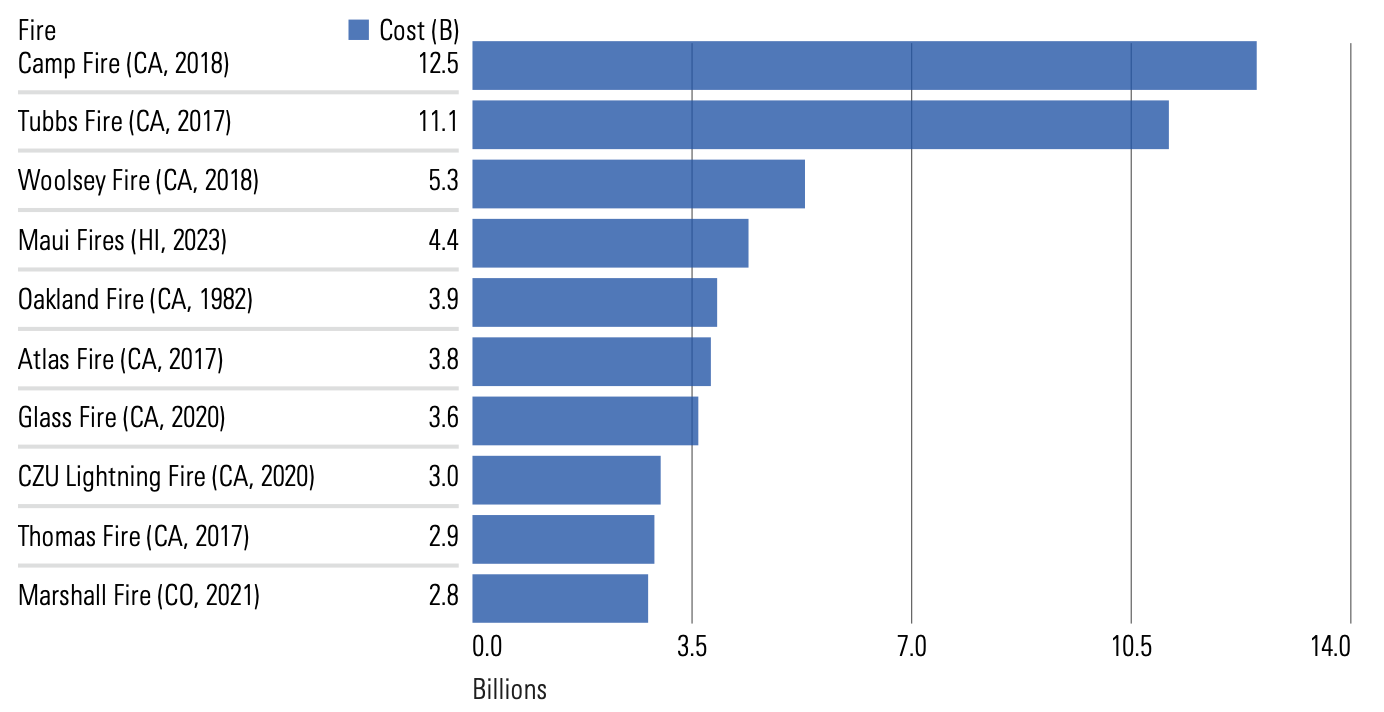

Despite a relatively mild fire season last year, the 2025 southern California wildfires may be an immediate concern—early damage estimates suggest the fires could be the most expensive wildfires in history and Edison International's (EIX) stock fell 26% in the three trading days after the fires started alone. With the western US remaining at the highest risk for wildfires, utilities best positioned to have limited risk in this category usually serve areas in the Midwest, Southeast (excluding Florida), and mid-Atlantic.

Eight of the 10 most expensive wildfires in US history have occurred in California.

Interest Rates

Interest rate expectations appear to have shifted again, affecting utilities in two ways. First, higher interest rates raise borrowing costs for utilities' infrastructure investments, slowing earnings growth. As utilities continue to issue and refinance debt at higher costs, passing along those higher financing costs to customers will require regulatory sign-off for bill increases.

Higher interest rates also make utilities' dividend yields less attractive. After a decade of historically high dividend yield premiums, the relationship has flipped in the last year. The current discount between utilities' 3.3% dividend yield and 4.7% 10-year US Treasury yield is the largest since 2008. Discounts this big have been short-lived during the last 30 years, suggesting utilities stocks could fall or bonds could rally to close the gap.

A shift toward rate cut expectations fed a yearlong rally in 2024.

Clean Energy

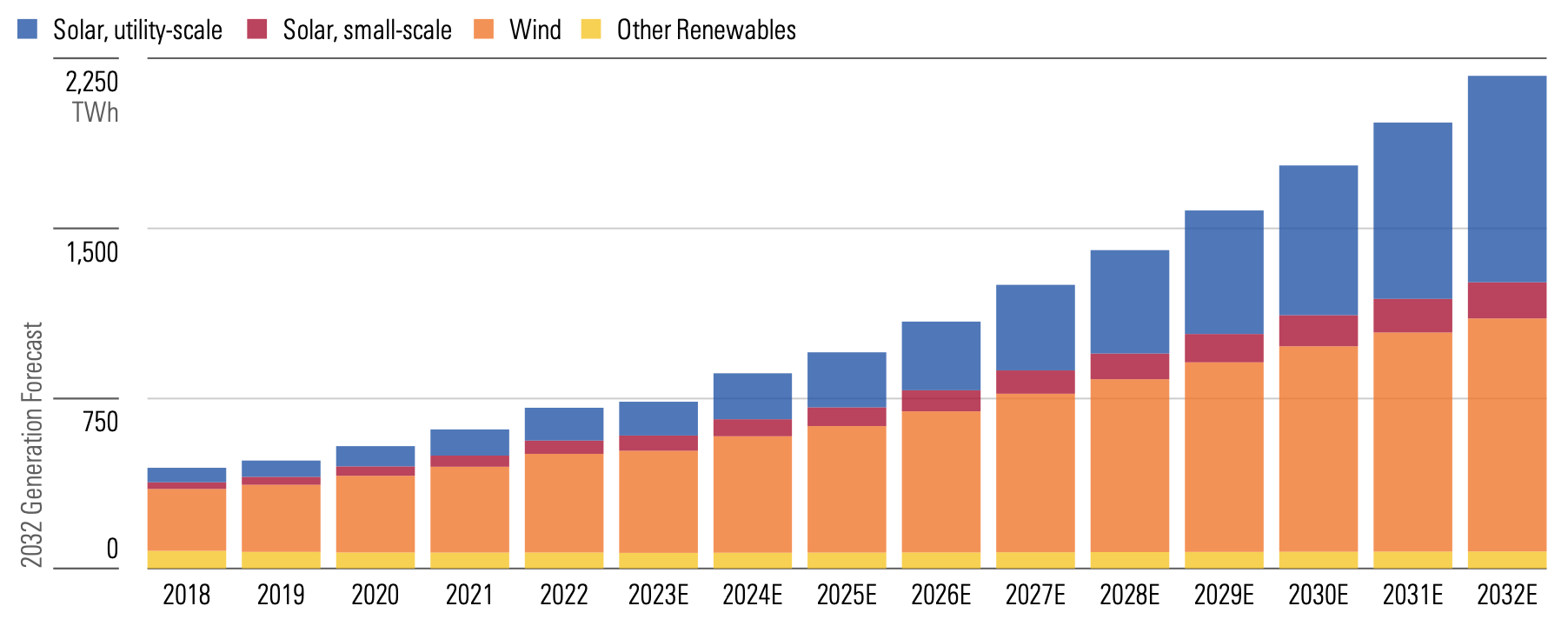

Solar is forecasted to be the fastest-growing clean energy technology during the next decade due to falling costs, location flexibility, and reliability benefits. In the long term, structural drivers such as technological advancements, cost declines, and state renewable energy policies ensure the energy transition will continue.

Plus, state renewable energy standards are helping to drive renewable energy growth. Many states' clean energy targets are fast approaching, and project development can take several years—making 2025 a critical year to prepare for 2028-30 deadlines.

Solar is half of all US renewable energy in our 2032 forecast, up from 21% in 2018.

Understanding the US Utilities Landscape

Overall, the US utilities sector is poised to grow in the coming years. Considering the rapid advancements in renewable energy and increasing regulatory pressures, it’s more important than ever for financial advisors to understand utility industry trends over this period.

The rise of renewable energy

One of the most significant shifts in the sector is the rapid growth of renewable energy sources. Over the past decade, falling costs for wind and solar projects and state-mandated renewable energy targets have spurred investments in clean energy. Renewable energy is now expected to surpass coal for the first time, making up over 16% of power generation.

While renewable energy offers a cleaner and often cheaper alternative to fossil fuels, it also requires substantial grid upgrades and storage solutions to ensure reliability. Utilities must continue to innovate and invest in smart-grid technologies and battery storage to accommodate this growing influx of renewable energy. These advances will ensure grid reliability and efficiency as renewable energy's share of the generation mix increases.

Revival of electricity demand growth

Historically, US electricity demand has mirrored economic growth, averaging around 2% annually. However, since 2000, this relationship has weakened due to improvements in energy efficiency and a decline in industrial electricity use.

Consequently, electricity demand has remained flat since 2007—but we’re likely on the cusp of a revival due to factors such as the proliferation of electric vehicles (EVs) and the surge of data centers fueled by advancements in AI. As a result, we expect demand to grow 1-2% annually.

These factors represent important opportunities for utilities to expand their services and infrastructure to meet growing electricity needs. This includes utilities preparing for increased demand by investing in grid capacity and reliability. Additionally, utilities might explore partnerships with EV manufacturers and charging network providers to capitalize on the expanding EV market.

Utilities as income investment proxies

Income-focused investors have long favored utilities due to their stable cash flows and high dividend payout ratios. Traditionally, utilities' dividend yields closely tracked the yields of 10-year US Treasury bonds. However, following the 2008 financial crisis, utilities' dividend yield premium peaked in mid-2020 as interest rates plummeted.

With interest rates normalizing, we expect utilities’ dividend yields to align more closely with bond yields. This adjustment reflects a return to pre-2008 norms, where utilities provided a reliable income stream with relatively lower risk.

This makes utilities a defensive play for investors during economic downturns, offering steady returns even amidst market volatility. Additionally, utilities' focus on sustainable energy investments and grid modernization creates opportunities for long-term growth, further solidifying their appeal as income-generating assets.

Deliver Value

The US utilities sector is undergoing a transformation driven by renewable energy expansion, increasing electricity demand, and stable investment returns. These dynamics underscore the critical role utilities play in shaping the nation's energy future.

Deepen your analysis of the utilities sector with Morningstar Data+Analytics. Our powerful capabilities gives you the tools and insights you need to make informed decisions—all backed by our independent research.

You might also be interested in...

Important Disclosure

The information, data, analyses, and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete, or accurate. The opinions expressed are as of the date written and are subject to change without notice.

Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses, or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar.

Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.