Positive Credit Trends Continue in First Quarter

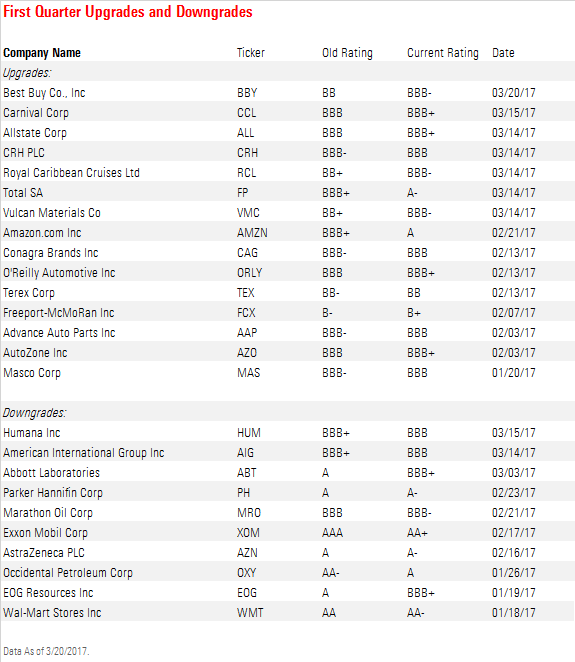

We upgraded 15 firms' ratings and downgraded 10 in the first quarter.

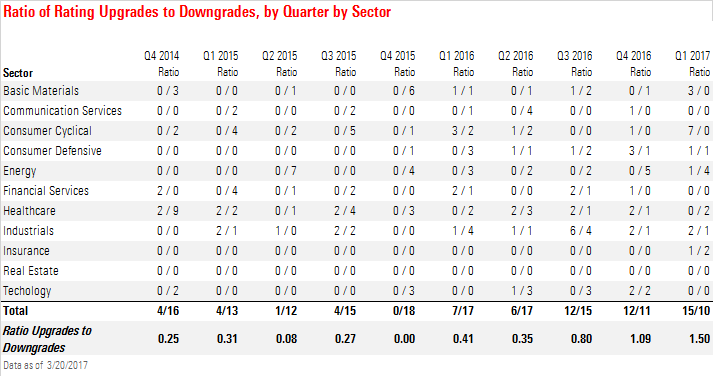

After upgrades slightly outpaced downgrades in the fourth quarter, our rating changes pushed firmly into positive territory in the first quarter, as we upgraded 15 firms and downgraded 10. The basic materials and consumer cyclical sectors saw the most upgrades while the energy and healthcare sectors were dominated by downgrades. Rating changes in other sectors were more balanced.

Deleveraging through debt redemption and profit growth remained a key theme for several sectors this quarter, and improving profit trends in the consumer cyclical sector led to nearly half of our upgrades. In basic materials, deleveraging produced upgrades at CRH (on debt redeemed after previous acquisitions and solid profits), Freeport-McMoRan (through asset sales), and Vulcan Materials (on EBITDA growth). In consumer cyclical, we upgraded seven firms (Advance Auto Parts, AutoZone, O’Reilly Automotive, Amazon, Best Buy, Carnival, and Royal Caribbean Cruises), all with signs of improving profitability. In consumer defensive, we upgraded Conagra Brands on recent portfolio restructuring activities. In energy, we upgraded Total on its improved operations and outlook since our downgrade in 2015. In industrials, we upgraded Masco on deleveraging through debt redemption and profit growth, and we upgraded Terex on deleveraging after a recent asset sale. In the insurance sector, we upgraded Allstate on a lower risk assessment of its insurance operations since our last rating action.

Profit pressure and acquisition activities were key themes in our downgrades. In consumer defensive, we downgraded Wal-Mart on its multiyear erosion of profitability. The energy sector was dominated by downgrades, as ExxonMobil, Occidental Petroleum, EOG Resources, and Marathon Oil finally succumbed to a lower baseline forecast of oil/gas prices after sharp declines in commodity prices since late 2014. In healthcare, we downgraded Abbott Laboratories after incorporating its recent leverage-increasing acquisition activity, and we downgraded AstraZeneca on its ongoing commitment to shareholder returns despite deteriorated cash flows. In industrials, we downgraded Parker Hannifin on a recent leverage-increasing acquisition. In insurance, we downgraded American International Group on significant returns to shareholders and ongoing operational problems, as evidenced by recent large reserve charges, and we downgraded Humana after its merger agreement with higher-rated Aetna was blocked.

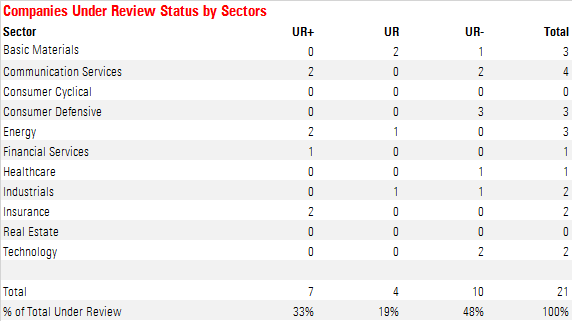

During the first quarter, we resolved 10 reviews and did not place any additional companies under review, causing the number of companies under review to fall to 21 as of March from 31 at the end of December. We expect more downgrades than upgrades from our current rating reviews. As of March 17, 48% of these under review firms were downgrade candidates (UR-), 33% were upgrade candidates (UR+), and 19% could go in either direction (UR).

While weak commodity prices remain a concern in basic materials, our current rating reviews in this industry are related to leverage-changing M&A and separations. Monsanto Co’s (rating: A/UR-) credit rating remains under review with negative implications on the company’s plan to merge with lower-rated Bayer AG (rating: A-/UR-) in a leverage-increasing transaction. Our credit ratings for Dow Chemical Co (rating: BBB/UR) and E. I. DuPont de Nemours & Co (rating: A-/UR) remain under review on merger plans; the direction and outcome of these reviews remain uncertain.

In communication services, our ratings for AT&T, CenturyLink, Sky, and Windstream remain under review on planned M&A activity. AT&T Inc (rating: BBB/UR-) plans to acquire Time Warner (rating: BBB+/UR-) in a leverage-increasing deal that could cut into their credit ratings. CenturyLink Inc’s (rating: BB/UR-) review is based on the firm’s plan to acquire Level 3, which may boost leverage enough to cut into its credit rating. Sky PLC’s (rating: BBB/UR+) review reflects Twenty-First Century Fox’s (not rated) plan to fully acquire it, which could have positive rating implications for the target. Windstream Holdings Inc’s (rating: B-/UR+) recent merger with EarthLink appears to have positive implications for its credit profile based on lower expected financial leverage and higher profitability relative to its stand-alone status.

In consumer defensive, leverage-increasing acquisitions also dominate our reviews. British American Tobacco PLC (rating: BBB+/UR-) remains under review with negative implications on its plan to buy the rest of Reynolds American Inc (rating: BBB/UR-), which is also under review with negative implications on this planned transaction. British American’s management team has stated a commitment to an investment-grade rating, but given the proposed debt financing, it could take several years to achieve investment-grade credit measures. Danone’s (rating: BBB+/UR-) rating remains under review on plans to acquire WhiteWave (not rated) in an leverage-increasing deal, which could lead to a downgrade of the acquirer.

In energy, Baker Hughes, Tesoro, and Western Refining remain under review. Our review of Baker Hughes Inc (rating: BBB+/UR+) relates to the firm’s planned merger with GE Oil & Gas. We understand that GE Oil & Gas will not bring any debt to the new combined entity, so the new entity should benefit from the combined cash flow of GE Oil & Gas and Baker Hughes and have lower leverage at inception. We are also reviewing the ratings on Tesoro Corp (rating: BBB-/UR) and Western Refining (rating: BB/UR+) on their pending merger. Assuming consummation of the deal, we estimate Tesoro’s pro forma gross and net leverage probably will not change substantially, including merger synergies. Therefore, our rating of the combined entity may be in line with Tesoro’s current rating, especially if refining industry conditions do not deteriorate further.

In financial services, Janus Capital Group Inc (rating: BBB/UR+) remains under review with positive implications on its pending merger with Henderson Group (not rated) in an all-stock deal that may lead to a better credit profile relative to the stand-alone entity.

In healthcare, Bayer AG’s (rating: A-/UR-) credit rating remains under review after the company agreed to acquire Monsanto Co (rating: A/UR-) in a leverage-increasing transaction. If completed as planned, we suspect the combined entity’s rating will be lower than Bayer’s current rating.

In industrials, Joy Global and Rockwell Collins remain under review on recent merger and acquisition activities. Joy Global Inc’s (rating: BB-/UR) rating remains under review on the company’s plans to be acquired by Japanese firm Komatsu (not rated). We expect to withdraw our rating on Joy upon consummation of the merger, which is expected in mid-2017. Our review of Rockwell Collins Inc (rating: A-/UR-) revolves around its agreement to buy B/E Aerospace (not rated), which will push up leverage initially, and its plan to shoot for a higher long-term leverage target than it operates with as a stand-alone entity.

In insurance, the Department of Justice’s attempt to block the merger of Anthem Inc (rating: BBB-/UR+) and Cigna Corp (rating: BBB-/UR+) was successful. However, Anthem is appealing that decision, and another court date is scheduled for April. Before this legal battle, our ratings assumed the merger would close as planned. But if it is not completed, we see the potential for positive credit rating implications for Anthem and Cigna, given the lower leverage that both firms could carry in stand-alone scenarios. The companies have not fully revealed their stand-alone capital-allocation plans, and we will continue to review their ratings until we have a better of sense of how they intend to manage their balance sheets in the long run.

In technology, acquisition activities and business reorganizations are the primary reasons for our rating reviews, and Time Warner and Analog Devices remain under review with negative implications on those activities. Our review of Time Warner Inc (rating: BBB+/UR-) relates to its planned combination with AT&T Inc (rating: BBB/UR-). Relative to Time Warner on a stand-alone basis, we project that the combined entity will operate with more leverage and a potentially weaker Business Risk profile, which could cut into its rating. Analog Devices Inc (rating: A+/UR-) remains under review with negative implications on its recent leverage-increasing merger with Linear Technologies (not rated).

Morningstar Credit Ratings, LLC is a credit rating agency registered with the Securities and Exchange Commission as a nationally recognized statistical rating organization (“NRSRO”). Under its NRSRO registration, Morningstar Credit Ratings issues credit ratings on financial institutions (e.g., banks), corporate issuers, and asset-backed securities. While Morningstar Credit Ratings issues credit ratings on insurance companies, those ratings are not issued under its NRSRO registration. All Morningstar credit ratings and related analysis contained herein are solely statements of opinion and not statements of fact or recommendations to purchase, hold, or sell any securities or make any other investment decisions. Morningstar credit ratings and related analysis should not be considered without an understanding and review of our methodologies, disclaimers, disclosures, and other important information found at https://ratingagency.morningstar.com.

/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PNCGQ5M56VGC5PJRBI7FPQIR7E.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/44L3CW3LNVDWRJVLPDI4GZKEIM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)